Olu Omodunbi, PhD

Chief Economist

“Growing up across three continents–Africa, Europe, and North America–I’ve been exposed to various financial tenets that helped mold my financial philosophy. That experience forged my passion for financial literacy, which helps individuals make better financial decisions.”

About Olu

As a senior vice president and the chief economist, Olu is responsible for setting the private bank’s economic view. He provides economic analyses and forecasts for clients within and outside the Chief Investment Office and represents Huntington in regional and national media.

With vast global experience and a deep commitment to community service, Olu analyzes wide-ranging data and helps people understand current economic trends and conditions. He is “touched” and “energized’ seeing his clients benefit from his research and guidance.

Valuable Insights

- Monetary policy

- International economics

- Financial economics

- Currencies

Accreditations

- BS, mathematics, New Jersey Institute of Technology

- PhD, economics, State University of New York (Binghamton)

- VP programming, Economic Club of Pittsburgh (National Association of Business Economics)

- Member of Slippery Rock University Economics and Finance advisory board council

- Past research director at Finance Requires Effective Education (FREE)

More from Olu Omodunbi, PhD

Videos

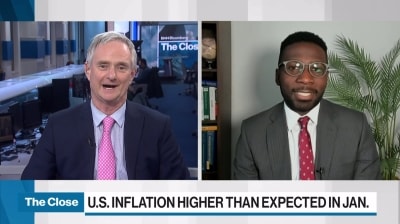

Olu Omodunbi appeared on Bloomberg TV’s “The Close” to discuss the higher-than-expected U.S. inflation report and what it means for the Fed, economy and markets.

Watch Video

Olu Omodunbi appeared on Yahoo Finance to discuss our 2025 outlook on inflation, the labor market and other economic factors that might influence Fed actions on interest rates.

Watch VideoPublications

Follow us on LinkedIn

If you’re looking for straightforward and clear information on markets and wealth planning – look no further. Follow Huntington Private Bank® for up-to-date market commentary and wealth management insights and guidance from our team of experts.

If you’re looking for straightforward and clear information on markets and wealth planning – look no further. Follow Huntington Private Bank® for up-to-date market commentary and wealth management insights and guidance from our team of experts.

Investment, Insurance and Non-deposit Trust products are: NOT A DEPOSIT • NOT FDIC INSURED • NOT GUARANTEED BY THE BANK • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • MAY LOSE VALUE

Huntington offers a full range of wealth management and financial services through dedicated teams of professionals in the Huntington Private Bank® and Huntington Financial Advisors®, as follows:

- Banking solutions, including loans and deposit accounts, are provided by The Huntington National Bank, Equal Housing Lender and Member FDIC.

- Trust and investment management services are provided by The Huntington National Bank, a national bank with fiduciary powers.

- Certain investment advisory solutions, securities, and insurance products are provided by Huntington Financial Advisors®.

- Certain insurance products are offered by Huntington Insurance, Inc. and underwritten by third-party insurance carriers not affiliated with Huntington Insurance, Inc.

Huntington Private Bank® is a federally registered service mark of Huntington Bancshares Incorporated.

Huntington Financial Advisors® is a federally registered service mark and a trade name under which The Huntington Investment Company does business as a registered broker-dealer, member FINRA and SIPC, a registered investment advisor with the U.S. Securities and Exchange Commission (SEC), and a licensed insurance agency.

The Huntington National Bank, The Huntington Investment Company, and Huntington Insurance, Inc., are wholly-owned subsidiaries of Huntington Bancshares Incorporated.

Minimum investment or deposit balance criteria apply with respect to the Huntington Private Bank. Please contact a Huntington Private Bank colleague for more information on eligibility requirements.