Digital Banking

As a Private Bank customer, you need services to help you manage your

wealth effectively—and that includes tools you can use digitally.

Make Deposits

Mobile Deposits – Make deposits with the Huntington Mobile app—all day, every day.

ATM Deposits – Deposit cash or checks directly into a Huntington ATM, no envelope or deposit slip required.

Direct Deposits – Automatically deposit your paycheck directly into your account.

Make Payments & Transfers

Bill Pay – Send payments straight from your phone or computer.

Zelle® – Send money to people you know in the mobile app.

Online Transfers – Transfer money between your Huntington accounts or make transfers to another financial institution‡.

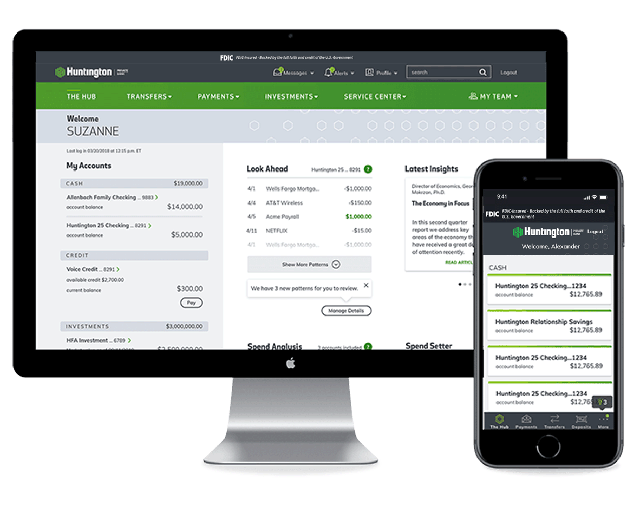

The Private Bank Hub

Your online banking experience is about to get better with The Private Bank Hub. While it's similar to The Hub, it now includes several unique tools to enhance your banking experience.

Learn More

Online Guarantee

At Huntington, we are committed to providing a secure and reliable online experience. You can be certain your money is safe and your payments will be sent on time. In fact, we guarantee it.

Learn More

Frequently Asked Questions

Here’s a list of frequently asked questions (FAQ) for The Private Bank Hub, so you can get more familiar with the digital tools that help you keep track of your spending and saving. Remember, you can learn more and explore these features by logging into your account and choosing Take the Tour under My Accounts on your Hub homepage.

General

Do I need a new username or password to get started with The Private Bank Hub?

No. Just use your Huntington username and password for Online Banking to access The Hub.

Where are my accounts?

All your accounts are listed under My Accounts. Click on an account for your transaction history, to see current balances, and other account details.

Where can I find online services?

Near the top of the page, you’ll see five areas in the main navigation:

- The Hub, for your accounts and financial tools;

- Transfers, to transfer money between your bank accounts;

- Bill Pay, to set up and pay bills electronically; and

- Service Center, where you can find contact information, view statements, order checks, manage your overdraft options and account settings, and more.

- My Team, which gives contact details of your Private Banker including phone number and email, and links you to the My Team page, for a list of your dedicated team of professional advisors.

Messages, alerts, and your profile can be reached using the buttons menus at the top right of the page.

How do I change the layout of The Private Bank Hub?

At the bottom of The Hub, click the Manage Hub & Tool Views link. Scroll through to The Hub Layout section and select how you want to view your account list and financial tools on the screen.

What security features are part of The Private Bank Hub?

Your online banking experience at huntington.com is backed by our strong commitment to security and privacy. Learn more at

huntington.com/Privacy-Security.

Does The Private Bank Hub work with all my accounts? What if I have personal and business accounts?

The type of accounts you have will determine which Hub tools are available to you. If you have both personal and business accounts, you will see a toggle that will allow you to switch views between your personal and business account tools. Just look for the green tabs above My Reminders. Some financial tools are exclusive to your personal or business accounts. Please note you must have your business account(s) linked to your Personal profile to see this hybrid view.

How do I choose which account I want The Private Bank Hub tools to analyze?

At the bottom of The Hub, click the Manage Hub & Tool Views link. You can select which accounts are included in your financial tools by default. Select at least one of the available accounts for each tool.

Transactions

How do I download my transactions?

For personal accounts, click on the account under My Accounts to visit the Account Details page. There you’ll see an option to Download Transactions. You can download transactions from the past month or set a custom date range. Your transactions can be downloaded into Quicken, QuickBooks, and CSV formats.

In the Spend Analysis Transaction Detail, what are tags?

Tags in the Transaction Detail window allow you to add a keyword or phrase to your transactions, to help you organize and track your finances. For example, you may choose to tag certain expenses related to a vacation or a charitable donation.

My Team

What is My Team?

My Team is a list of your dedicated team of professional advisors. For those clients with an assigned Private Banker, it allows you to easily contact that banker when you select My Team in the upper right of the green menu bar in The Hub or choose the Go To My Team Page. The phone numbers and email addresses listed are active links so you can reach your Private Banker from your computer or the Huntington Mobile app, just by tapping on the details. It also allows you to add the phone numbers and email addresses to your smartphone contacts.

Latest Insights

What are the Latest Insights?

Latest Insights provide videos, articles, whitepapers, and more to help you stay informed on the market and current economic conditions. Scroll through the carousel by clicking the buttons and arrows to see new topics and features. Choose one of the three panels which will open a new page or video with full details and related resources.

What can I expect from the Latest Insights?

With comprehensive insights from Huntington’s Private Bank leadership, you’ll see market outlooks, economic reports, guidance on handling cybersecurity and ID theft, and succession planning ideas for you and your business.

My Reminders

What is My Reminders?

My Reminders is a list that shows future transactions to predict what you’ll make based on patterns in your spending and income, as well as those patterns you’ve created for yourself. Patterns appear as reminders of upcoming bills like tuition, car payments, or membership dues. It also shows scheduled bill payments and internal account or bank-to-bank transfers. My Reminders is just a prediction, but it helps you keep tabs on your cash flow.

What's considered a Pattern?

My Reminders uses advanced algorithms to analyze money coming in and going out to detect consistently repeated patterns. For example, if you pay your child’s tuition every three months, My Reminders will recognize this. These recognized, consistently repeated transactions (by date range, payee, and amount) whether income or an expense, are considered Patterns.

How does the My Reminders tool determine which patterns to show in The Private Bank Hub?

The My Reminders tool will display weekly, bi-weekly, and monthly patterns. You’ll see upcoming patterns for the next few weeks on your homepage of The Hub. You can select See More Patterns to expand the list. Or, select Manage Patterns to see other patterns My Reminders has identified.

Can I create my own pattern or change what is shown in My Reminders?

Yes! Just go to Manage Patterns where you can review Patterns, see what’s active, and choose which Patterns can be ignored. Then click on Create a Pattern to make your own, giving yourself reminders on upcoming bills or regular deposits.

Which of my accounts are included in My Reminders?

All Huntington Checking and Savings accounts and credit cards are integrated with My Reminders.

Spend Analysis

What is Spend Analysis?

On The Private Bank Hub, Spend Analysis provides you an overview of your spending by transaction category for the current month. Click View Analysis to dive deeper into your financial history, or to change the date range of what’s displayed or a category.

Which of my accounts are included in Spend Analysis?

For personal accounts, Spend Analysis includes transactions from your Huntington Checking and credit card accounts. For business accounts, Spend Analysis includes transactions from your Huntington Checking, money market, and credit card accounts.

Can I hide a transaction from Spend Analysis and Spend Setter?

Yes, you can hide transactions, so they aren’t included in the Spend Analysis or Spend Setter tools. Click on a transaction to bring up the Transaction Detail window and check Hide this transaction from financial tools.

How do I see my spending for the previous month?

To see your spending for previous months, click the View Analysis button. On the larger Spend Analysis view, you can change the date range, dive into categories, and more.

What are categories and how are they determined?

Categories group together similar transactions to give you an accurate snapshot of where your money goes each month. For example, the category Dining: Coffee Shop would allow you to know just how much of your money went toward lattes. Categories will vary between your personal and business accounts.

Every transaction is automatically assigned a category, initially from this default list. You can recategorize a transaction anytime. Click on a transaction to bring up the Transaction Detail window. Then click Edit to open the Select Category window.

How do I add, edit, or delete a category?

Your spending is organized into category families, such as Dining or Travel.

To add, edit, or delete a category, click on a transaction to bring up the Transaction Detail window. Then click Edit to open the Select Category window. Open a category family to add, edit, or delete categories. Up to 10 categories can be added to each family. The category family itself cannot be deleted or modified.

My transaction is in the wrong category. How do I move it?

You can recategorize a transaction anytime. Click on a transaction to bring up the Transaction Detail window. Then click Edit to open the Select Category window.

After you change a category, you will be asked if you’d like to create a rule to automatically assign similar transactions or merchants to your preferred category in the future.

Can I split a transaction into more than one category?

Yes! Let’s say you go to a department store and pay $300 on clothing and $200 on a gift. The $500 transaction will automatically be categorized as Shopping: Clothing. Simply click on the transaction to bring up the Transaction Detail window. Then click Edit next to Splits to open the Split Transaction window.

How are cash and checks categorized?

In your transactions, cash deposits will be categorized within the Income family and cash withdrawals will be considered Financial Activity: Cash Withdrawal. Any check you write will be categorized Financial Activity: Check. To improve the accuracy of your financial tools, you can recategorize these transactions. Click on the transaction to bring up the Transaction Detail window. Then click Edit next to Category to open the Select Category window.

Or you can use a debit or credit card instead of cash or checks. Card transactions provide a clearer picture of your spending habits.

Spend Setter℠

What is Spend Setter?

Spend Setter helps you control the amount of money you spend within any given month. Track your spending by setting monthly spending limits for categories like Groceries, Restaurants, and Entertainment.

How are budgets set up? Can I change them?

If you don’t use the Spend Setter tool within the first 60 days of having access, budgets will be created for your highest three spending categories based on your monthly averages. To edit these budgets, click View Budgets.

How do I create or edit a budget?

In The Hub, click View Budgets. You’ll then be able to edit any budget or create a new one. You can create up to 10 total budgets.

Which of my accounts are included in Spend Setter?

Spend Setter includes transactions from your Huntington checking and credit card accounts.

How long is a budget tracked?

Your budgets reset each calendar month.

Savings Goal Getter℠

What is Savings Goal Getter?

Savings Goal Getter helps you visualize a Savings Goal—or more than one—by giving it a name, amount, and due date to reach it.

Which of my accounts can have a Savings Goal? Is there a limit to how many I can set up?

You can add Savings Goals to all your Huntington personal savings and money market accounts. You can add up to 10 Savings Goals, and one Emergency Fund, to each account.

How do I put money toward my Savings Goals?

Once you've created your goals, we'll automatically assign money in your savings or money market account towards each goal depending on the goal amount and the date you want to reach it.

How is it determined which goals my money goes to?

Money is assigned first to your Emergency Fund (if you have one) then to additional Savings Goals based on the amounts and due dates you set up. The Savings Goal with the nearest due date will be assigned money first. If more than one goal has the same due date, money will first go to the goal most recently created.

Can I move money between my Savings Goals?

Since money is assigned to your Savings Goals based on due dates, you can change the amount of money in each goal by editing the due dates. Remember, money will always be assigned first to an Emergency Fund (if you’ve created one) and then the Savings Goal with the nearest due date.

Do Savings Goals earn interest?

You earn interest on the money in your savings or money market account, whether or not you have created a Savings Goal. The Savings Goal itself does not earn interest.

How do I add or change a Savings Goal?

You can add or change a Savings Goal as often as you like. To create a goal, click Add a Savings Goal, then give it a name, amount, and due date. To edit a goal, click Edit next to an individual goal. Remember, changing the amount or due date will change how much or how often you need to deposit or transfer money to reach that goal.

How do I delete a goal?

To delete a goal, click Edit next to the goal, then click Delete next to the trash can icon. Remember, if you delete a Savings Goal, your progress toward other goals for that account will adjust automatically.

How is it determined which goals are shown on The Private Bank Hub homepage?

On The Private Bank Hub main page, you will see up to three goals in online banking, and one goal in the mobile app. If you have set up an Emergency Fund, that will be displayed first. Additional goals will be listed in the order of nearest due date. If more than one goal has the same due date, they will be listed in the order of largest percent complete first. If all goals have been reached, they will be listed in the order of most recently completed.

What happens when I complete a Savings Goal?

Congratulations! Once you complete a goal and are ready to use the money, you'll see Edit and Make a Transfer options. We recommend you transfer or withdraw the money from your savings or money market account to use for the goal. Then, delete the goal so that other money in your account isn't assigned to the goal you just completed!

What is the maximum amount I can have for a goal?

You can assign up to $1 million to each Savings Goal.

Contact Us

We're here for you and your business.

Find a Private Bank Office

Find your nearest office today.

Speak with Us

Daily 7:00 a.m. to 7:00 p.m. ET

Ask us Online

You have a few ways to get help.

† Message and data rates may apply.

‡ Payments outside the United States are not permitted, except for payments to individuals or entities in Puerto Rico or the U.S. Virgin Islands. Regulations limit the number of transfers that can be made on savings and money market accounts.

FINRA BrokerCheck

See more about Huntington Financial Advisors and our investment professionals at FINRA BrokerCheck. Learn more.

Investment, Insurance and Non-deposit Trust products are: NOT A DEPOSIT • NOT FDIC INSURED • NOT GUARANTEED BY THE BANK • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • MAY LOSE VALUE

Huntington offers a full range of wealth management and financial services through dedicated teams of professionals in the Huntington Private Bank® and Huntington Financial Advisors®, as follows:

- Banking solutions, including loans and deposit accounts, are provided by The Huntington National Bank, Equal Housing Lender and Member FDIC.

- Trust and investment management services are provided by The Huntington National Bank, a national bank with fiduciary powers.

- Certain investment advisory solutions, securities, and insurance products are provided by Huntington Financial Advisors®.

- Certain insurance products are offered by Huntington Insurance, Inc. and underwritten by third-party insurance carriers not affiliated with Huntington Insurance, Inc.

Huntington Private Bank® is a federally registered service mark of Huntington Bancshares Incorporated.

Huntington Financial Advisors® is a federally registered service mark and a trade name under which The Huntington Investment Company does business as a registered broker-dealer, member FINRA and SIPC, a registered investment advisor with the U.S. Securities and Exchange Commission (SEC), and a licensed insurance agency.

The Huntington National Bank, The Huntington Investment Company, and Huntington Insurance, Inc., are wholly-owned subsidiaries of Huntington Bancshares Incorporated.

Minimum investment or deposit balance criteria apply with respect to the Huntington Private Bank. Please contact a Huntington Private Bank colleague for more information on eligibility requirements.

Spend Setter℠ and Savings Goal Getter℠ are service marks of Huntington Bancshares Incorporated.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.