And there doesn't appear to be a slow-down anytime soon as schools expand amenities and services to remain competitive.

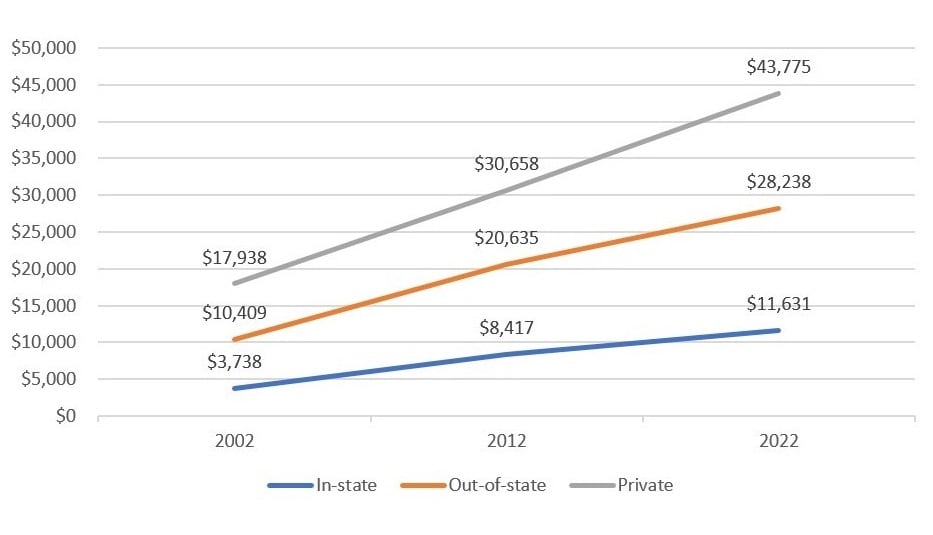

As the chart below† shows, college tuition has increased significantly in the last 20 years, more so than any good or service other than hospital care‡.

Higher education tuition since 2002

Variables Impacting Your Costs

Even if your child won't be a freshman for another 5, 10 or 15 years, it's really important to start saving and investing now. The sooner you start planning the more prepared you’ll be when those tuition bills arrive.

The first question is what type of school your student may attend? In addition to the three types in the chart above, community colleges and trade schools are great options that can lead to challenging, well-respected, and well-paying jobs. Also, both likely require shorter-term attendance, which could reduce costs§.

Before we get into tuition and associated costs, there will be expenses incurred even before the first day of school. This saving for college calculator can help you budget for expenses faced while applying.

How Much to Save for College?

After the type of education and school have been narrowed down, you can begin figuring out potential costs. In addition to tuition, there'll be room and board, transportation, books, supplies and other expenses to consider.

Fortunately, there are some steps to help take the sting out of college costs:

- Consider community college

- Look for high school and college credits

- Consider filling out the Free Application for Federal Student Aid (FAFSA)

- Look for discounts and scholarships

- Some schools may reduce costs based on need if you negotiate

- Consider online courses

You'll also decide what portion of the costs you'll cover. Will your child shoulder some of the burden? Will scholarships and grants be available? Can relatives provide some support? How much college debt is worth taking on? Here's a Huntington college savings calculator that might help find out how much it'll take to save for a college education.

Ways to Save for Kid's College Fund

There are numerous options at your disposal to prepare for that college fund, including educational savings plans and prepaid tuition plans that can be purchased directly from a state or financial advisor.

A Section 529 college savings plan (aka 529 plan) is a good one to seriously investigate. It's a tax-advantaged account that can be used in some states to pay up to $10,000 for educational expenses from kindergarten through 12th grade, and with no maximum for college through graduate school, including apprenticeship programs.

The primary tax benefit is that withdrawals are tax-free if used for qualified education expenses. And to make it extra easy, setting up a 529 plan is designed for the do-it-yourselfer. Generally, a 529 may have little to no impact on other financial aid and will be of more help than a hinderance¶. Also, new changes to FAFSA (as of Oct. 1, 2023) eliminates what once was a 'financial aid trap' for 529s held by grandparents#.

Here's a list of the 529 college savings plans in the states with Huntington presence:

| Plan Name | Tax benefit for in-state contributors? | Minimum contribution | |

|---|---|---|---|

| Colorado | CollegeInvest | Yes | $25 |

| Illinois | Bright Start 529 Plan | Yes | $0 |

| Indiana | CollegeChoice 529 | Yes | $10 |

| Kentucky | KY Saves 529 | No | $25 |

| Michigan | Michigan Education Savings Program | Yes | $25 |

| Minnesota | MN Saves | Yes | $25 |

| Ohio | Ohio's 529 College Advantage | Yes | $25 |

| Pennsylvania | PA529 | Yes | $10 |

| West Virginia | SMART529 | Yes | $1 |

| Wisconsin | Edvest | Yes | $25 |

A Coverdell education savings account has a few more restrictions than a 529 plan, but unlike a 529, can cover costs beyond tuition.

Other options to consider to help pay for education expenses:

- Put money into eligible savings bonds

- Start a Roth IRA

- Put money into a custodial account

- Invest in mutual funds

- Take out a home equity loan

Here's another Huntington calculator to help you determine what investments to use to save for college, which includes 529s and Coverdells.

Connect with Huntington's Advisory Resource Group

Setting up 529 plans and others are designed for the do-it-yourselfer. Huntington Financial Advisors can no longer open 529 Plans for clients as of Jan. 1, 2023, but can provide some guidance and assist with the other options to consider. Please be aware that Change of Dealer requests and additional deposits for 529 Plans are no longer accepted. If an addition needs to be made, customers should send checks directly to their plan sponsor.