What Affects Your Credit Score?

When preparing to buy a new house or lease a car, it’s nerve-wracking to know a credit score can play a role in the outcome of these major life decisions, especially if your score is lower than you’d like. But what exactly goes into a credit score and how can you use this information to help improve your score?

At Huntington, we’re here to assist you in each step of your financial journey, and understanding what affects a credit score is an important step in taking control of your finances.

Click to where you need:

What factors affect credit scores?

Your credit score is a three-digit number used to measure your credit-worthiness and is calculated by a mathematical equation that evaluates the information in your credit report. Most credit scores range on a scale from 300-850, with higher scores seen as more credit-worthy. The majority of creditors use your FICO Score, which is credit information provided by one of the three major credit reporting agencies (Experian, Equifax, and TransUnion) and created by Fair Isaac Corporation.

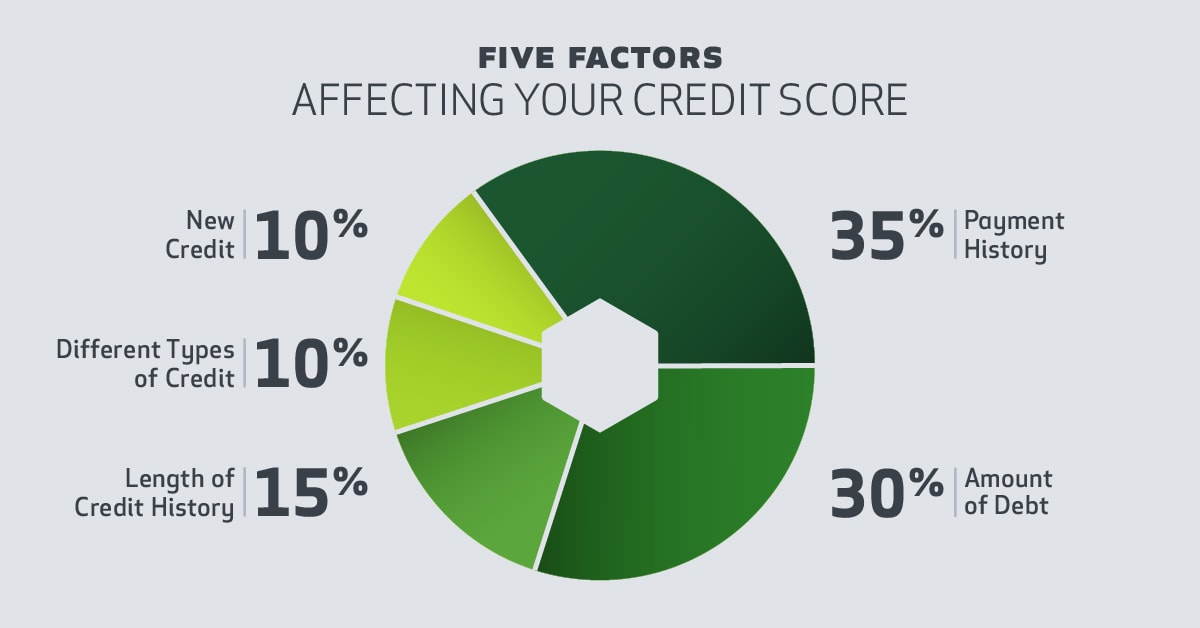

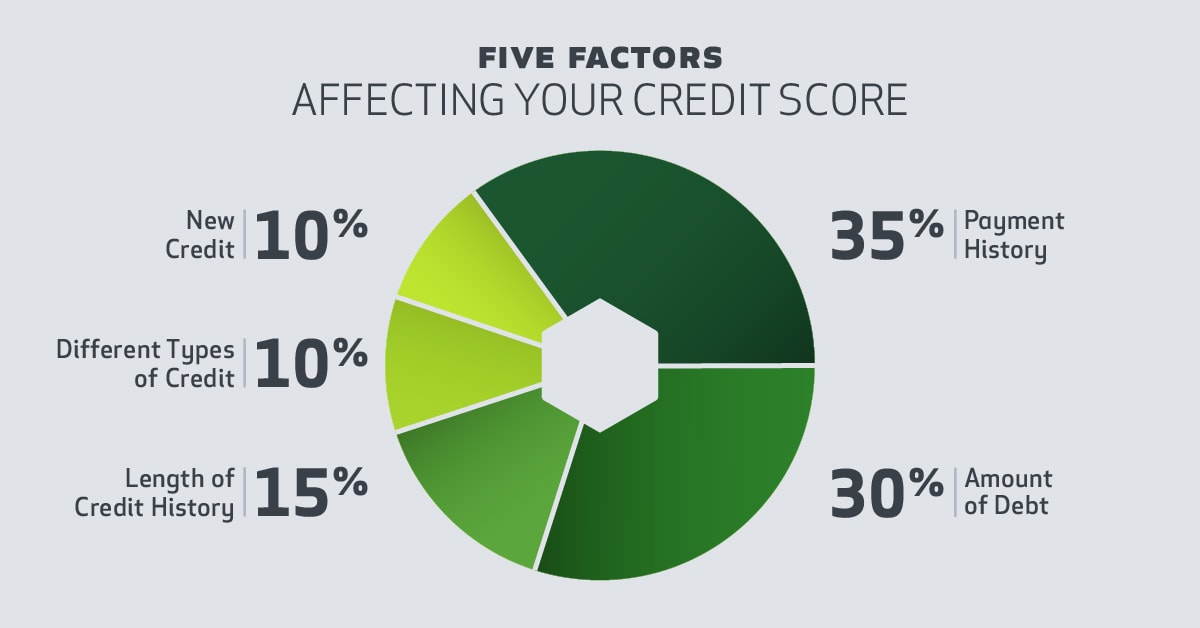

There are five factors most commonly used to calculate your credit score, but the exact effect of each factor can vary based on credit scoring models. For a FICO Score, the factors are:

- Payment History – 35%

- Amount of Debt – 30%

- Length of Credit History – 15%

- Different Types of Credit – 10%

- New Credit – 10%

Each factor holds a weighted percentage of your credit score, which means some can be more effective at lowering or raising a credit score than others. Read on to learn the breakdown of each factor and tips to help improve your credit score.

Payment History

Payment history accounts for 35% of your FICO Score, making it the largest indicator of how responsible of a borrower you are. This factor examines:

- Payment information on many types of accounts like credit cards, retail accounts, installment loans, and finance company accounts.

- Public record and collection items – reports of bankruptcies, foreclosures, lawsuits, wage attachments, liens, and judgments.

- Details on late or missed payments and public record collection items.

- The number of accounts that show no late payments or are currently paid as agreed.

Creditors and lenders want to be sure you’ll pay back your debt, so it’s important to prioritize paying your bills on time.

Amount of Debt

Amount of debt, or debts owed, generally makes up 30% of your calculated credit score. This factor refers to how much debt you carry in total. A person is not necessarily deemed a high-risk borrower simply by having credit accounts or owing money. Although, as your balances increase, it also increases the difficulty and probability of being able to meet monthly payments on time. In other words, using too much of your available credit, may be interpreted by lenders and banks as having a higher risk of defaulting.

There are nuances to scoring amounts owed and determining how much is too much for an individual credit profile. These are five additional factors that are evaluated in this category.

- The amount owed on all accounts.

- The amount owed on different types of accounts.

- How many accounts have balances.

- Credit utilization ratio on revolving accounts.

- How much of the installment loan amounts is still owed, compared with the original loan amount.†

Credit Utilization

Credit utilization looks at the amount you owe compared to the amount of credit you have available. You can calculate your credit utilization rate by dividing your total credit card balances by your total credit card limits. For example, if you have a $1,000 balance on one credit card and a $2,000 balance on another, and each card has a $6,000 credit limit, your credit utilization rate would be 25%.

Your credit utilization rate matters to lenders because it helps determine the overall financial risk of lending to you. Regularly spending or exceeding your credit limit each month sends red flags to lenders, signaling you may have a hard time paying off your credit card and interest.

To help avoid a high utilization rate, consider using no more than 30% of your credit limit. Using below 30% of your credit limit is a general guideline, so understand that using even less is better for your score.

Length of Credit History

The length of credit history refers to the age of accounts that appear in your credit report. Credit scoring models consider:

- How long credit accounts have been established. For example, a FICO Score (the most common credit scoring model) looks at the age of the oldest account, the age of the newest account, and the average age of all accounts.

- How long specific credit accounts have been established.

- How long it has been since you used certain accounts.

If you’re just beginning to build credit, this factor may seem discouraging. But, rest assured, when it comes to credit growth, time is on your side. A longer credit history will help increase a credit score all else being equal, especially if your accounts have a positive payment history and no delinquency.

Different Types of Credit

Creditors review the mix of credit cards, retail accounts, installment loans, finance company accounts, and mortgage loans when considering lending to you. You don’t need to have one of each and you shouldn’t open a new credit line that you won’t use, but it’s a good idea to have a few to show you’re an experienced borrower and can handle monthly payments on various lines of credit.

When thinking about the different types of credit you have, there are two types that can affect your credit score:

- Revolving credit: This is one of the most common types of credit. You can borrow freely, but it has a credit limit and requires monthly payments and interest charges if you carry a balance. It typically includes credit cards and home equity lines of credit (HELOC).

- Installment credit: These are loans for a set amount of money with a fixed, regularly occurring repayment schedule. It includes all kinds of loans, such as student loans, mortgages, auto loans, or personal loans.

Apply for a Huntington Credit Card Online

Find the credit card benefits that work for your lifestyle. From establishing credit or saving money with lower rates, to earning 1.5% unlimited cashback or 3x rewards in a category of choice, we have the card that’s right for you.

Learn More

New Credit

New credit only accounts for credit lines or loans you apply for that you did not have before. If you receive a preapproved offer for a new credit card or loan, this wouldn’t be new credit. You have to formally apply and be approved for these to appear on your credit report. Your credit score considers:

- How many new accounts have been opened.

- How long it has been since a new account was opened.

- How many recent requests for credit have been made, as indicated by inquires to the consumer reporting agencies.

- Length of time since inquiries from credit applications were made by lenders.

When applying for a new line of credit, you may see a slight drop in your credit score between the application and acceptance because of the hard inquiry on your credit report. Don’t worry about this too much. Hard inquiries don’t have a huge effect on your credit score unless you have a short credit history or a few applications in a short amount of time.

Opening a new line can affect your credit score over time, and it’s important to pick an option that works best for you. At Huntington, we offer a variety of credit cards, each with their own benefits, like earning rewards or lower interest rates, to help meet your needs.§

What helps lower your credit score?

Being mindful of these five factors can show great financial results but neglecting them can also cause your credit score to suffer. Be aware of these common financial mistakes that lower scores:

- Late payments: Creditors can start to report payments when they are at least 30-days late. Late payments can have a huge impact on your credit score. The later the payment, the worse it is for your credit. Before being late for any payment, FICO recommends that you reach out to your creditor, who may be willing to work with you and your financial situation.‡

- Holding high credit card balances: If you have a $1,000 credit limit on your credit card, it doesn’t mean it’s wise to spend it all at once. Having a healthy credit utilization ratio (using 30% or less of available credit) shows creditors you’re a fiscally responsible borrower. Plus, as your debt grows, so does the amount of interest you pay, which can create a hole of debt that’s difficult to climb out of.

- Applying for new lines of credit: It is important to diversify your credit mix, but you should only open a new line of credit when you really need it. Every time you apply for a new line of credit, a hard inquiry is made to your credit report, which can ding your credit score, even if you aren’t approved.

- Not enough credit diversity: Only having one type of credit in your portfolio can make creditors hesitant to lend to you. It may feel confusing to know that applying for new lines of credit and not enough credit diversity can both hurt your score. Try to wait at least six months before applying for a new line of credit to help avoid negative effects from too many credit inquiries.

- Canceling zero-balance credit cards: It’s rewarding to pay off a credit card, but you might want to consider holding onto it. Canceling the credit card reduces your credit limit, consequently raising your credit utilization ratio. Canceling a card can also shorten the length of your credit history. After 10 years, a closed credit card may not appear on your credit report losing years of hard work.

How to help build your credit score

Learning what affects your credit score can certainly feel overwhelming, but with some patience, practice, and dedication, there are numerous ways to help build credit.

- Maintain a low credit utilization rate: Try your best to keep your balance as low as possible on all your cards. Some recommend keeping your credit utliization ratio below 30%.

- Stay under your credit limit: Going over on your limit may cause you to incur fees and extra payments that only make it harder to stay on top of your debt.

- Pay bills on time: Keep your credit score in good standing or get back on track by paying your bills on time. The longer you consistently make payments on time, the more potential for your credit score to increase.

- Pay past-due bills: Pay your past-due bills as fast as you’re able, especially before they appear on your credit report, which could cause your score to decline. A late payment can start to appear on your credit report if it is at least 30 days past due.‡ A quick way to ensure you consistently pay your bills on time would be to sign up for automatic bill payments.

- Build credit for the rent you pay: Your rent may be your biggest bill each month, so consider building credit with it. There are services you can pay your rent through so it will be reported to the three credit bureaus.

- Correct errors on your credit reports: You are entitled by law to a free credit report every 12 months, so it’s a good idea to check your credit report to make sure there are no errors that may lower your score.

†myFico. N.d. “What is Amounts Owed?” Accessed July 5, 2023. https://www.myfico.com/credit-education/credit-scores/amount-of-debt

§Voice Credit Card Terms and Conditions, Voice Rewards Terms and Conditions, Cashback Card Terms and Conditions, Cashback Rewards Terms and Conditions.

‡myFico. N.d. “What are the different categories of late payments and how does your FICO® Score consider late payments?” Accessed July 5, 2023. https://www.myfico.com/credit-education/faq/negative-reasons/late-payments

FICO® is a registered trademark of the Fair Isaac Corporation in the United States and other countries.

The information provided in this document is intended solely for general informational purposes and is provided with the understanding that neither Huntington, its affiliates nor any other party is engaging in rendering financial, legal, technical, or other professional advice or services, or endorsing any third-party product or service. Any use of this information should be done only in consultation with a qualified and licensed professional who can take into account all relevant factors and desired outcomes in the context of the facts surrounding your particular circumstances. The information in this document was developed with reasonable care and attention. However, it is possible that some of the information is incomplete, incorrect, or inapplicable to particular circumstances or conditions. NEITHER HUNTINGTON NOR ITS AFFILIATES SHALL HAVE LIABILITY FOR ANY DAMAGES, LOSSES, COSTS OR EXPENSES (DIRECT, CONSEQUENTIAL, SPECIAL, INDIRECT OR OTHERWISE) RESULTING FROM USING, RELYING ON OR ACTING UPON INFORMATION IN THIS DOCUMENT EVEN IF HUNTINGTON AND/OR ITS AFFILIATES HAVE BEEN ADVISED OF OR FORESEEN THE POSSIBILITY OF SUCH DAMAGES, LOSSES, COSTS OR EXPENSES.

Third-party product, service and business names are trademarks/service marks of their respective owners.