Ways New Technology Can Help You Manage Your Debt

There are apps to help you understand your debt picture, and budget your way out of it.

If you’re reading this, you’ve already taken the most critical step toward a debt-free life: deciding to deal with your debt. “Getting out of debt is not rocket science,” says Bethany Palmer, co-author of The 5 Money Personalities and half of the financial coaching duo The Money Couple. “It takes a plan that you can get excited about and stick to, one that’s right for you‡.”

Easier said than done, but Palmer speaks from inspiring experience. At one point in their marriage, she and her husband Scott were shouldering a whopping $100,000 in credit card debt and had just $219 to their names. Ignoring their problem would have been disastrous, resulting in long-term credit harm and an even bigger debt. The only way out of that mess, they realized, was settling on a plan that was actually doable.

Apps can help clear the view of your debt.

To see the way out of your debt and build a repayment plan, you have to understand the various types of debt you may have. Some debt will have higher interest rates than other debt, and there may be other factors affecting cost. You may need help from someone experienced in debt terms, or your Huntington banker can help provide options.

The good news is that there are many useful debt apps and tools, such as Undebt.it and Debt Payoff Planner (Android and iOS). These apps and tools can tally up your total debt and show you how different repayment strategies will play out over time.

The Palmers, for example, chose to pay off the highest-interest debt first, the so-called avalanche strategy. (See our guide to debt terms here.) Then, they moved down the line to tackle each debt in succession until they were debt-free. Another option is to address the smallest—or most achievable—debt first, for the sense of satisfaction of knocking it off (the “snowball” strategy).

Once you choose the approach that’s right for you, the apps and tools can show you how paying a certain amount each month can reduce your debts faster. At any point, you can view key figures such as the total amount owed, total monthly payments, interest, and payoff dates for each debt.

Spend Analysis

Tracking Your Spending Just Got Easier

Track how much you're spending, and exactly where you're spending it, in categories like groceries and entertainment. We'll analyze your expenses so you can easily see exactly where your money is going.

Learn More

Apps help keep your payback plan on budget.

With a plan in hand, the key is to avoid overspending. Your best bet is a good old-fashioned budget. This can all be done with pen and paper or an Excel sheet, but if crunching numbers sounds like a nightmare, don’t despair.

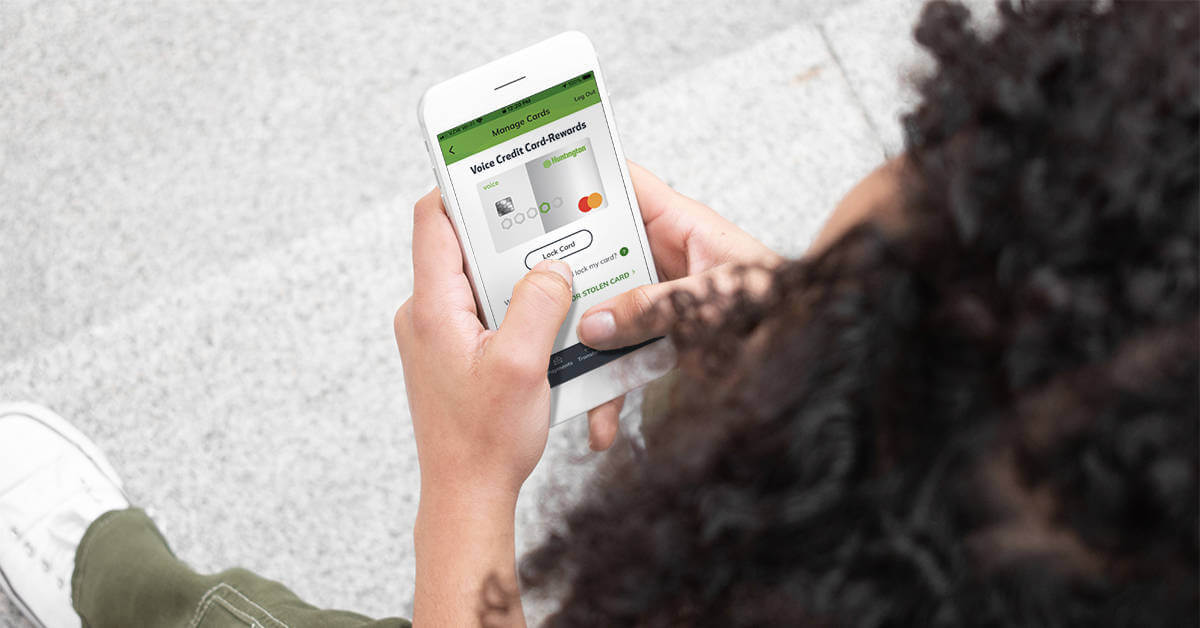

If you’re a Huntington customer, you can manage your budgeting and spending with our site, The Hub, which can track spending and help you set and monitor financial goals. Spend Setter℠ can make budgeting less painful by helping you set monthly spending limits by category. If you have a Huntington credit or debit card, Spend Setter can track your transactions against the limits you set in any category. You can also use the Hub’s Spend Analysis to get a clear visual picture of your spending habits and trends, along with Huntington Heads Up®, which can send you alerts† about upcoming payment due dates.

Beyond The Hub

If you feel like you need support to help you work through what feels like overwhelming debt, or you want to work through this with an actual person, check out this list of resources.

These tools and resources can help inspire some debt plan ideas. When building your actual plan, please talk to your Huntington banker to see how we may be able to help.

The information provided in this document is intended solely for general informational purposes and is provided with the understanding that neither Huntington, its affiliates nor any other party is engaging in rendering financial, legal, technical or other professional advice or services, or endorsing any third-party product or service. Any use of this information should be done only in consultation with a qualified and licensed professional who can take into account all relevant factors and desired outcomes in the context of the facts surrounding your particular circumstances. The information in this document was developed with reasonable care and attention. However, it is possible that some of the information is incomplete, incorrect, or inapplicable to particular circumstances or conditions. NEITHER HUNTINGTON NOR ITS AFFILIATES SHALL HAVE LIABILITY FOR ANY DAMAGES, LOSSES, COSTS OR EXPENSES (DIRECT, CONSEQUENTIAL, SPECIAL, INDIRECT OR OTHERWISE) RESULTING FROM USING, RELYING ON OR ACTING UPON INFORMATION IN THIS DOCUMENT EVEN IF HUNTINGTON AND/OR ITS AFFILIATES HAVE BEEN ADVISED OF OR FORESEEN THE POSSIBILITY OF SUCH DAMAGES, LOSSES, COSTS OR EXPENSES.

Third-party product, service and business names are trademarks and/or service marks of their respective owners.

† Carrier’s message and data rates may apply.

‡ From interview with Scott and Bethany Palmer, 10/29/18.

Spend Setter℠ is a service mark of Huntington Bancshares Incorporated.

Huntington Heads Up® is a federally registered service mark of Huntington Bancshares Incorporated.