Your identity is valuable, and fraudsters are constantly trying to get your information in different ways. The following precautions can help protect your identity and your money.

How common is identity theft?

Identity theft is more common than you might assume. The Federal Trade Commission (FTC) most recently reported that more than $1 million reports of identity theft were received through their IdentityTheft.gov website. Consumers also report losing more than $10 billion to fraud†. Such staggering numbers can seem overwhelming, but taking precautionary measures can help you protect your identity and you money.

How can I help protect my identity?

Protecting your identity starts with you. Here are a few tips on how you can help keep your information safe, especially online and digitally.

- Use Strong Passwords and Enable Multi-Factor Authentication (MFA): Create complex passwords and activate MFA on your accounts to add an extra layer of security.

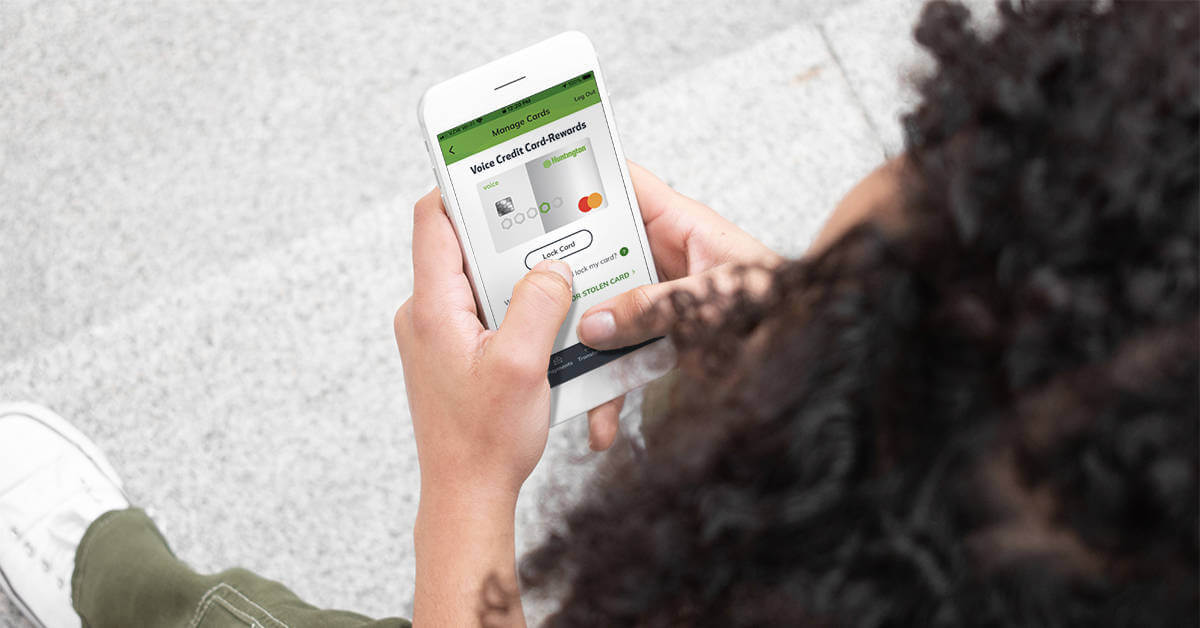

- Monitor Your Financial Accounts Regularly: Keep a close eye on your bank and credit card statements for any unauthorized transactions.

- Be Cautious with Personal Information: Share your personal details sparingly and only with trusted people or organizations.

- Secure Your Devices and Networks: Ensure your devices are protected with up-to-date security software, and avoid using unsecured Wi-Fi networks.

- Consider Identity Monitoring Services: Use services that alert you to suspicious activity involving your personal information. Lean more about Huntington alerts.

Help Protect Children from Identity Theft

Children are often targets of identity theft because their credit histories are clean. Fraudsters can use a child's Social Security number to open accounts or commit fraud without detection for years.

- Keep your child's Social Security number and personal information private

- Monitor their credit report periodically

- Monitor their internet usage. Find more tips in our guide.

What to Do if Your Identity is Compromised

If you're a victim of identity theft, it's important to act quickly. While it can take a while before everything gets back to normal, taking smart, deliberate actions can help you get your identity back. Read more in Huntington's guide to Rebuilding Your Identity.

The threat of identity theft can feel overwhelming, but small steps can make a big difference to help safeguard your information and finances.