Stretching Your Paycheck to Fit Your Life

Tips on how to make it work.

Seven years ago, Michelle Schroeder-Gardner† was in a constant state of money stress, regularly running low on funds as she grappled with a whopping $38,000 in education debt.

"I lived paycheck to paycheck for years," says the founder of Making Sense of Cents, a personal finance website‡, who lived and worked in St. Louis, Missouri. “Even little purchases were stressful, and there were sleepless nights."

It's a feeling many Americans know well. Living without a financial buffer is common, says Rachel Schneider, co-author of The Financial Diaries: How American Families Cope in a World of Uncertainty, a book that chronicles the financial challenges faced by 235 low- and middle-income families over the course of a year§. But take heart: the following financial fixes may help you cope.

Look at your large expenses.

Tracking your expenses and focusing on big-ticket wins can help jumpstart your budget fix journey. A single move with big impact—for instance, getting a roommate, which will halve your rent—could be worth hundreds of small saving and skimping steps.

Huntington National Bank branch manager, Adrian Vestemean, who works with customers at the bank’s Northville, Michigan, branch to help them reach their financial goals, offers a roadmap. "Start by listing every expenditure you have for the month into columns of wants or needs," he suggests. "Where things fall will tell you if you're living out of your means or right on budget. Then you can look at the 'want' column and decide whether you might want to take steps to save such as downsizing to a smaller home or do without a car."

Hide your savings.

Schneider says the families she studied found stashing cash in an account that was difficult to access or even see was helpful. Even if it’s just a small amount, having something set aside in case of emergency can help make a big difference. "Create barriers for yourself so that you're less likely to raid your savings," she suggests, adding that automating savings has a similar benefit. (You can set savings goals in the Savings Goal GetterSM tool on The Hub.) "It's an out-of-sight, out-of-mind effect—a nice little savings pool builds up while you're not paying attention."

Spend Analysis

Tracking Your Spending Just Got Easier

Track how much you're spending, and exactly where you're spending it, in categories like groceries and entertainment. We'll analyze your expenses so you can easily see exactly where your money is going.

Learn More

Tackle timing troubles.

If you find yourself anxiously awaiting payday as payment due dates pass, rescheduling your billing cycles can be a life-changing move—you can learn more about billing cycles here. "It's often as simple as calling your credit card or utility company and asking if they'll let you change," says Schneider.

Explore new ways to earn more money.

When careful management and cost trimming don’t cut it, consider looking for ways to boost your income. While asking for a raise or improving your skills and finding a job that pays more are time-consuming and difficult, they can make a real difference, says Schroeder-Gardner, whose own journey to financial stability involved taking on side jobs and, ultimately, a career change.

"What really helped me in addition to budgeting better is learning how to make extra money," she says. "I realized that I could use my extra time to get more hours, freelance, and more." Ultimately, Schroeder-Gardner was able to pay off her loans, and trade her full-time job as a financial analyst for a career as a blogger that she was more passionate about.

Earning more can help ease financial stress, which may help make life a little easier#. For more money-finding moves, see our article “Earning ideas for a cash infusion.”

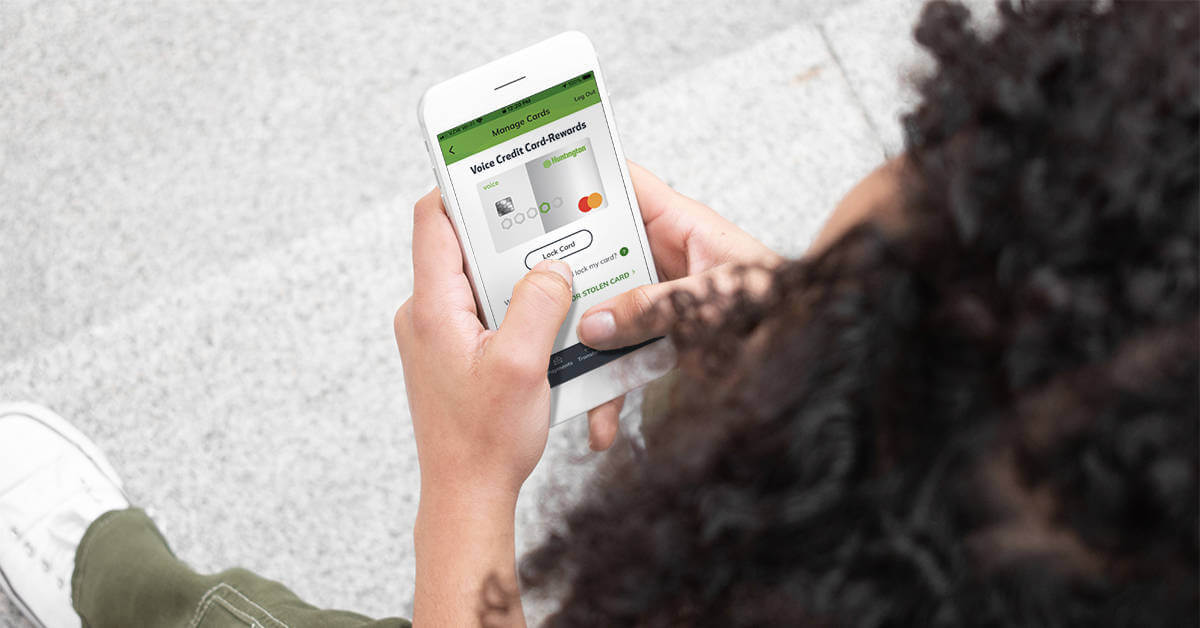

Make technology your wallet watcher.

Huntington customers can manage budgeting and spending through The Hub. "You can set goals, such as how much you want to spend per month on groceries, and it will keep track of your daily spending against that goal and send you alerts¶ when you’re coming up against your spending limit,” explains Vestemean.

Life can present challenges that make surviving from one paycheck to another almost impossible, but some of these tips may make managing a little easier.

To get help with your overall financial picture, check out The Hub, or stop in to talk with your local Huntington banker.

† Schroeder-Gardner, Michelle. Interview. October 31, 2018.

‡ Making Sense of Cents,

https://www.makingsenseofcents.com

§ Schneider, Rachel. The Financial Diaries: How American Families Cope in a World of Uncertainty. [Accessed April 2019].

# "Money Stress Weighs on Americans’ Health," Monitor on Psychology, Q4 2015.

https://www.apa.org/monitor/2015/04/money-stress. [Accessed April 2019].

¶ Message and data rates may apply.

Savings Goal Getter

SM is a service mark of Huntington Bancshares Incorporated.

The information provided in this document is intended solely for general informational purposes and is provided with the understanding that neither Huntington, its affiliates nor any other party is engaging in rendering tax, financial, legal, technical or other professional advice or services, or endorsing any third-party product or service. Any use of this information should be done only in consultation with a qualified and licensed professional who can take into account all relevant factors and desired outcomes in the context of the facts surrounding your particular circumstances. The information in this document was developed with reasonable care and attention. However, it is possible that some of the information is incomplete, incorrect, or inapplicable to particular circumstances or conditions. NEITHER HUNTINGTON NOR ITS AFFILIATES SHALL HAVE LIABILITY FOR ANY DAMAGES, LOSSES, COSTS OR EXPENSES (DIRECT, CONSEQUENTIAL, SPECIAL, INDIRECT OR OTHERWISE) RESULTING FROM USING, RELYING ON OR ACTING UPON INFORMATION IN THIS DOCUMENT EVEN IF HUNTINGTON AND/OR ITS AFFILIATES HAVE BEEN ADVISED OF OR FORESEEN THE POSSIBILITY OF SUCH DAMAGES, LOSSES, COSTS OR EXPENSES.