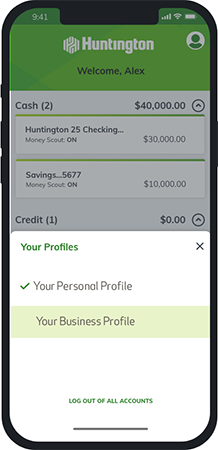

Save Time with an Integrated Online and Mobile Experience

With this new feature for business owners, your business and personal checking accounts can be accessed with one login. Easily switch between consumer and business profiles for a complete view of your Huntington relationship^.

To learn more about this feature, talk to a banker today.

Introducing a new way to reduce fees for your business

Your business and personal checking accounts are better together. When you have both qualifying accounts with Huntington, you get more features, more services, and more options to waive monthly maintenance fees on your business checking account† ‡.Unlimited Plus Business Checking

- Waived $40 monthly maintenance fee with $50,000 in total deposit relationship balances or when you also maintain a Huntington Platinum Perks Checking®, Private Client, or Huntington SmartInvest Checking® account‡.

- Unlimited transactions#

- Up to $25,000 in cash deposits; $0.30 fee for each $100 after

- Two bonus services listed below

Unlimited Business Checking

Bonus Services Available

We give you even more ways to boost your business goals.

Fraud Tool

Add reverse positive pay to help protect your account at no charge.

Remote Deposit Capture

Receive $25/month credit towards your desk top check deposit scanner.

Wires

No charge on two incoming domestic wires per month.

Returned Deposited Items

No return deposit item fees on up to 25 occurrences per month.^Business accounts on which you hold at least a 25% beneficial ownership interest according to Huntington’s client records and are a signer on will be available to view through your personal login.

†The business can avoid the monthly checking maintenance fee ($20.00) for any statement period on the Unlimited Business Checking account when the business keeps a total deposit relationship balance of at least $10,000 in a combination of deposits held directly by us. Eligible deposits are this checking account and any other checking, money market, savings, or certificate of deposit (CD) account(s) owned by the business, but deposits owned by separate legal entities (even those that share EINs or TINs) are not eligible. We figure the total relationship deposit balance each month by adding the average daily balance for all eligible deposit account balances of the business for the applicable statement period. We calculate the average daily balance by totaling the balances in your account from the end of each day in the applicable statement period and dividing that amount by the number of days in that period. However, for new accounts or closed accounts, we only count the number of days that the account was open during the applicable statement period for purposes of determining the average daily balance. Personal Checking Account Relationship Benefit: The business can also avoid the monthly checking maintenance fee for any statement period on this business checking account when a business owner maintains a personal Huntington Perks Checking® Account through that same statement period. Business ownership for the purposes of this benefit is defined as a 25% or greater beneficial ownership interest and is determined by information in Huntington’s client records. To remove the benefit of a personal relationship, the owner of the personal checking account will need to contact (800) 480-2001.

‡The business can avoid the monthly checking maintenance fee ($40.00) for any statement period on the Unlimited Plus Business Checking account when the business keeps a total deposit relationship balance of at least $50,000 in a combination of deposits held directly by us. Eligible deposits are this checking account and any other checking, money market, savings, or certificate of deposit (CD) account(s) owned by the business, but deposits owned by separate legal entities (even those that share EINs or TINs) are not eligible. We figure the total relationship deposit balance each month by adding the average daily balance for all eligible deposit account balances of the business for the applicable statement period. We calculate the average daily balance by totaling the balances in your account from the end of each day in the applicable statement period and dividing that amount by the number of days in that period. However, for new accounts or closed accounts, we only count the number of days that the account was open during the applicable statement period for purposes of determining the average daily balance. Personal Checking Account Relationship Benefit: The business can also avoid the monthly checking maintenance fee for any statement period on this business checking account when a business owner maintains a personal Huntington Platinum Perks Checking® Account, Private Client Checking Account, or a SmartInvest Checking® Account through that same statement period. Business ownership for the purposes of this benefit is defined as a 25% or greater beneficial ownership interest and is determined by information in Huntington’s client records. To remove the benefit of a personal relationship, the owner of the personal checking account will need to contact (800) 480-2001.

#A “transaction” is any combination of checks paid, deposit tickets, deposited checks (except those you process through a remote deposit scanner), incoming ACH debits and credits, debit card purchases and bill payment transactions made through Huntington’s Online Bill Pay service.

¶Payroll processing services provided by Paychex, a third party commercial vendor. The Huntington National Bank is not an affiliate of Paychex, and does not provide, warrant, or guarantee their products or services.

Huntington SmartInvest Checking®, Huntington Perks Checking®, and Huntington Platinum Perks Checking® are federally registered service marks of Huntington Bancshares Incorporated.