Spend Analysis

Tracking your spending just got easier.

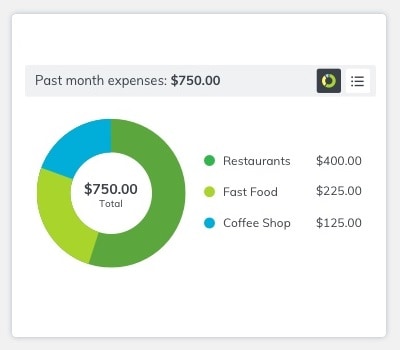

Track how much you're spending, and exactly where you're spending it, in categories like groceries and entertainment. We'll analyze your expenses so you can easily see exactly where your money is going.Open a Huntington Checking account and start tracking your spend today.

Make purchases using your Huntington credit or debit card. The more you use your credit or debit card, the more transactions Spend Analysis will track.

Spend Analysis will automatically put each transaction into a category such as groceries, shopping, or entertainment.

Quickly see how you're doing when you log in to The Hub and track your spending trends over time.

Modern Expense Tracking

Stay on Track

Compare your Spending and Income

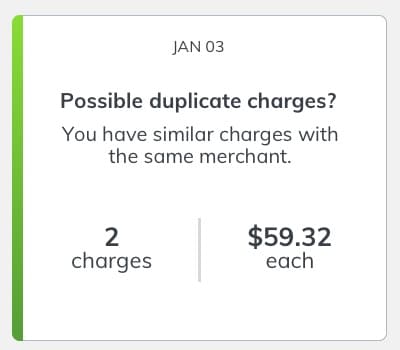

Real-Time Insights

Learn more about Huntington Heads Up

Message and data rates may apply.

Already a Huntington customer?

Money management – made simple.

Positive steps to help cut your debt - and stress.

Frequently Asked Questions

Answer: Spend Analysis tracks how much you're spending, and exactly where you're spending it, in categories like groceries and entertainment. We'll analyze your expenses so you can easily see exactly where your money is going.

Answer: For personal accounts, Spend Analysis includes transactions from your Huntington checking and credit card accounts. For business accounts, Spend Analysis includes transactions from your Huntington checking, money market, credit card and credit line accounts.

Answer: Do you have a Huntington checking account? Then log into The Hub to turn Spend Analysis on.

Answer: We’re working on it. For now, only your Huntington accounts and credit cards are included.

Answer: When you make a purchase using your debit or credit card, Spend Analysis places that purchase in an existing category, such as Groceries, Education, Home and more. You can also create subcategories and split purchases between categories to help you keep a more detailed record of your spending habits.

Answer: For your convenience, each transaction is automatically assigned to a category. To reassign a transaction, follow these easy steps:

- Click on a transaction from the line-item list. A Transaction Detail window will pop up. (Note: Pending transactions cannot be reassigned).

- Under Category, click Edit and select a new category.

- Answer Yes, Create Rule to always categorize this way, or No, Apply Once for one-time only.

Answer: To be more specific on how you track expenses, you can create new categories. For example, you can choose to track "coffee shop" spending separate from the main Restaurant category. Add up to 10 custom subcategories within a broader category family by following these easy steps:

- In Transaction Detail, under Category, click Edit.

- Click Add a category.

- Enter the new category name, then Save.

Answer: Get a more accurate picture of your actual spending by splitting a single transaction into two or more spending categories. Follow these easy steps:

- In Transaction Detail, under Category, click Edit.

- Choose Edit next to Category, select Category.

- Enter Split Amount for each category.

- Need to split into more categories? Click Add a Split.

- Click Save.

Answer: Yes, you can hide transactions so they aren’t included in the Spend Analysis or Spend Setter tools. Click on a transaction to bring up the Transaction Detail window, and check Hide this transaction from financial tools.

Answer: To see your spending for previous months, click the View Analysis button. On the larger Spend Analysis view, you can change the date range, dive into categories and more. You can also switch from pie chart to bar graph to table view and roll over visual charts to see amounts and percentages by category.

Answer: With Spend Analysis, you can see up to two years of spending and income history to better understand your habits. And, the Spend v. Income feature within Spend Analysis provides you with an easy-to-read, side-by-side comparison of money coming in and money going out. You can compare your cash flow for the past 12 months. All of this gives you the ability to make informed decisions about your money.