Overdrafts and Returns Explained

We want to help you avoid overdraft fees. So, as a Huntington customer, if you accidentally overdraw your account by $50 or less, you won’t be charged an overdraft fee thanks to our $50 Safety Zone®. And, if you have an overdraft that is more that $50 or possible returned transactions, you have more time to fix it, avoid an overdraft fee or return, and have your transactions paid with 24-Hour Grace®.##

What are overdrafts and returns?

Overdrafts

An overdraft occurs when you don't have enough money in your account to cover a transaction, and the bank pays it.Returns

A return occurs when you don't have enough money in your account to cover a transaction and the bank does not pay it. That transaction, or item, is marked as returned.When you do not have enough money in your account, the bank will pay or return a transaction, based on your overdraft elections. And there are also circumstances where the bank will not allow your account to be overdrawn. The bank systematically evaluates your ability to overdraft based on a variety of factors such as tenure, deposit frequency, overdraft history, bankruptcy history, etc. The bank pays overdrafts at our discretion and does not guarantee that we will always authorize and pay any type of transaction.

We all need a little relief.

We want to help you avoid overdraft fees and returns. So all Huntington customers have two things always working on their behalf: $50 Safety Zone and 24-Hour Grace. Here's how it works:

$50 Safety Zone##

If you overdraft up to $50, you won’t be charged an overdraft fee. Overdraft more than $50, you’ve still got...

Ways to avoid overdraft fees and returns

The best way to protect yourself from overdraft fees and returns is to know your balance and be sure you don’t spend money you don’t have. Talk to a Huntington banker about overdraft options for your debit card, ATM transactions, checks, and electronic (ACH) transactions. Here are more things you can do:

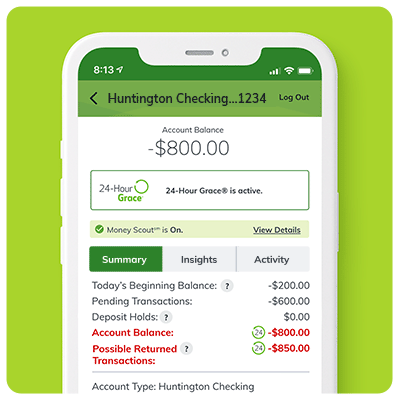

How overdrafts and returns appear in the Huntington Mobile app

If your account is overdrawn, your account balance will turn red and the 24-Hour Grace icon will appear. Overdrafts are reflected in your account balance.

Returns will appear below your account balance in the "Possible Returned Transactions" line.

In this example, $1,650 plus the additional amount needed to cover transactions that might post that day would need to be deposited to pay the transactions and avoid any overdraft fees. You may also incur fees from the merchant if your transaction is returned.

Understanding the Costs

|

What's the Fee

|

What It Means

|

Would 24-Hour Grace Apply?

Learn More |

Would $50 Safety Zone Apply?

Learn More |

|

|---|---|---|---|---|

| Overdrafts ? | $15 | Fee charged if we allow a transaction to go through even though you don't have enough money in your account¶. |

|

|

| Returns | $0 | You won't be charged a fee when you don't have enough money in your account and we return an item (for example, a check is "bounced" or a transaction is returned unpaid). |

|

- |

Choose the options that are right for you.

| ATM & Debit Card Transactions ? |

Opt in The bank has your permission to consider authorizing transactions even if you don’t have enough funds in your account. (It’s still at the bank’s discretion to decide.) You could incur overdraft fees if your account remains overdrawn after midnight Central Time the next business day§. If Huntington elects not to authorize your transaction, your transaction will be declined. You will not incur a fee for declined transactions. |

Opt out In most cases, transactions will be declined if you don’t have enough money in your account. You will not incur an overdraft fee for those transactions or a fee for declining them. |

|---|---|---|

| Checks, Electronic Payments, and Transfers ? |

Opt in The bank has your permission to consider paying transactions even if you don’t have enough funds in your account. (It’s still at the bank’s discretion to decide.) You could incur overdraft fees if your account remains overdrawn after midnight Central Time the next business day. If Huntington does not pay your transaction and if you do not make a deposit by midnight Central Time the next business day to cover the total amount of possible return transactions and your overdrawn balance plus the additional amount needed to cover transactions that might post that day, this will result in the transaction being returned and you may incur fees from the merchant.# |

Opt out In most cases, transactions will be returned unpaid if you don’t have enough money in your account. You will not have to pay an overdraft fee. If Huntington does not pay your transaction and if you do not make a deposit by midnight Central Time the next business day to cover the total amount of possible return transactions and your overdrawn balance plus the additional amount needed to cover transactions that might post that day, this will result in the transaction being returned and you may incur fees from the merchant#. |

Three examples of our overlapping coverage

Overdrafts of $50 or less:

If you start the day with $50 in your account and spend $75 at dinner with your debit card, your account balance is now -$25. but with $50 Safety Zone##, you won't be charged an overdraft fee since your account is overdrawn by $50 or less. (Reminder: if you are opted out, this transaction will be declined.)

Overdrafts of more than $50:

Let's say you start the day with $50 in your account and spend $150 at the grocery store, your account balance is now -$100. With 24-Hour Grace, we give you until midnight Central Time the next business day to make a deposit or transfer and avoid overdraft fees. Make a deposit or transfer that brings your account balance positive, including new transactions that are being processed that day, and we'll waive the overdraft fees.

Returns:

You have $50 in your account when your $1,500 mortgage payment is scheduled to auto-pay that day. If we decide not to pay that into overdraft, we'll give you more time to make a deposit and have your mortgage paid with 24-Hour Grace. Make a deposit or transfer that covers transactions pending return plus enough funds for any new transactions being processed that day, and we'll pay your transaction.

Have more questions about overdrafts and returns?

Answer: When you do not have enough money in your account, the bank decides whether it will pay or return an item based on your overdraft elections.

An overdraft occurs when you don't have enough money in your account to cover a transaction and the bank pays it. Examples are overdrafts caused by check, in-person withdrawal, debit card purchase, ATM withdrawal, or other electronic means.

A return occurs when you don’t have enough money in your account to cover a transaction and the bank does not pay it. Examples of returns include checks and electronic paymentsⱢ.

Answer: 24-Hour Grace: Overdrafts

We will not charge an overdraft fee unless your account is overdrawn by more than $50. When your account is overdrawn by more than $50, 24-Hour Grace gives you more time to make a deposit and avoid overdraft fees. Just make a deposit or transfer that brings your account to a positive balance, before midnight Central Time on the next business day.

We understand that overdrafts happen. If you are enrolled in Standby Cash, you can access your Standby Cash credit line for help. If you believe you're going to overdraw your account, you can use Standby Cash and make a transfer to prevent the overdraft from occurring.†

Example:Let’s say you start the day with $50 in your account and spend $150 at the grocery store, your account balance is now -$100. With 24-Hour Grace, we give you until midnight Central Time on the next business day to make a deposit or transfer and avoid overdraft fees.

Make a deposit or transfer that brings your account to a positive balance, including new transactions that are being processed that day, and we’ll waive the overdraft fees.

24-Hour Grace: ReturnsIf you forgot about a check you wrote, or an automatic payment that was scheduled to debit your account, and you don’t have enough funds in your account, 24-Hour Grace gives you more time to make a deposit to cover any transactions that we would have returned unpaid. Just make a deposit or transfer to bring your account balance positive, including new transactions from that day (such as debit card transactions, written checks, and scheduled automatic payments) plus the total amount of possible return transactions before midnight Central Time of the next business day. If not, the transactions will be returned unpaid, and you may incur fees from the merchant.

We understand that overdrafts happen. If you are enrolled in Standby Cash, you can access your Standby Cash credit line for help. If you believe you're going to overdraw your account, you can use Standby Cash and make a transfer to prevent the overdraft from occurring.†

Example:You have $50 in your account when your $1,500 mortgage is scheduled to auto-pay that day. If we decide not to pay that into overdraft, we’ll give you more time to make a deposit and have your mortgage paid with 24-Hour Grace.

Make a deposit or transfer that covers the total amount of your possible return transactions, plus any new transactions that are being processed that day, and we'll pay your transaction.

Answer: The best way to protect yourself from overdraft and return fees is to know your balance and be sure you don’t spend money you don’t have. Here are three more things you can do:

- Talk to a Huntington Banker about overdraft options for your debit card, ATM transactions, checks, and electronic (ACH) transactions.

- Sign up for Overdraft Protection and link a savings account to your checking account. So, if you spend more money than you have in your checking account, we’ll automatically transfer money from your savings to cover the difference—for free.

- Understand the suite of tools and services Huntington offers to help you avoid overdraft fees or transactions being returned. Tools like Huntington Heads Up® account alerts§ keep you informed and on top of your money. If you believe you're going to overdraw your account, you can use Standby Cash® and make a transfer to prevent the overdraft from occurring. (A 5% cash advance fee is applied when you make the transfer.).†

Please note, while these tools can help you avoid overdrafts, there are limitations that may impact your Standby Cash eligibility.

Answer: Yes, unless you ask us not to, we do authorize and pay overdrafts for checks, electronic payments, and transfers. Remember, it is always at the bank’s discretion to decide whether or not to pay a transaction. We do not guarantee that we will always pay any type of transaction.

Answer: No. If your debit card purchase was declined, you will not receive an overdraft fee.

Answer: You can sign up for overdraft protection option anytime by visiting a Huntington branch or calling (800) 480-2265.

Answer: You may change your overdraft options by calling (800) 445-3658 between the hours of 7:00 a.m. to 8:00 p.m. daily, or by visiting any Huntington branch to speak with a banker. Customers enrolled in Online Banking or the Mobile App may be able to log in and select Overdraft Options to make changes.

Answer: 24-Hour Grace gives you until midnight Central Time the day after you overdraw your account, or have eligible returns to make a deposit to bring your account balance positive, including new transactions from that day (such as debit card transactions, written checks, and scheduled automatic payments) plus the total amount of possible return transactions. We will not charge an overdraft fee unless your account is overdrawn by more than $50 ($50 Safety Zone).

For example, you overdraw your account on a Tuesday and have possible return transactions eligible for 24-Hour Grace. You have until midnight Central Time on Wednesday to bring your account balance positive plus the total amount of possible return transactions. Customers enrolled in Huntington Heads Up alertsΩ will receive an email (and/or text message or push alert) the business day after they overdraw or have possible returned transactions, which is Wednesday in our example.

Contact Us

Automated Assistant

Quick answers when you need them

Speak with Us

We are here to help

Find a Branch

Find your nearest Huntington Branch

† Standby Cash is subject to terms and conditions and other account agreements. A cash advance fee equal to 5% of the amount of the cash advance will be collected from your Eligible Deposit Account immediately after the cash advance is deposited in that account. A 1% monthly interest charge (12% Annual Percentage Rate) will be added to outstanding balances if automatic payments are not scheduled. Available through online banking or the Huntington Mobile app to individuals with an active Huntington consumer checking account with at least three months of consistent deposit activity of $1,000 or more, and an average daily balance of $200 or more over the last 30 days. An active or recent bankruptcy or other legal process may disqualify you. Other eligibility requirements apply, including your recent overdraft and/or return history, regardless of whether you are charged overdraft fees or have transactions returned or they are waived with our 24-Hour Grace® and $50 Safety Zone® services. We reserve the right to change eligibility criteria at any time. Line amount and/or ongoing availability may vary based on changes to your deposit activity, average daily balance, and number and length of overdrafts and/or returns on any of your Huntington deposit accounts. When any of your Huntington deposit accounts are in an overdraft status for more than one day, your Standby Cash line will be suspended until they are no longer negative. If 90% or more of the approved credit line is drawn three months in a row, Standby Cash will be suspended until it’s paid to a zero balance. Business checking accounts are not eligible for Standby Cash.

##Your account will be automatically closed if it remains negative in any amount for 60 days. including if your account is overdrawn within our $50 Safety Zone. Learn more at huntington.com/Grace and huntington.com/SafetyZone

§Increments of $100 can be transferred from available funds in a savings or money market account, and the transfer fee is $0. See additional information in the Huntington Consumer Deposit Account Agreement.

Increments of $100 can be transferred from a personal credit line, up to the available credit limit and subject to the applicable personal credit line APR. Transfers can be made from a Voice Credit Card® up to 10% of the available credit limit and subject to the applicable cash advance APR. Terms and conditions for funding account still apply, such as paying interest on the credit lines. Not subject to grace periods.

ΩMessage and data rates may apply.

¶Limit of 3 Overdraft Fees per day. There is no overdraft fee assessed when an account is overdrawn by $50 or less.

#We must receive your deposit by the next business day after your account is overdrawn by making a deposit at a branch before closing or before midnight Central Time at an ATM, by mobile deposit, or online transfer.

ⱢThe bank systematically evaluates your ability to overdraft based on a variety of factors such as tenure, deposit frequency, overdraft history, bankruptcy history, etc. The bank pays overdrafts at our discretion and does not guarantee that we will always authorize and pay any type of transaction.

Voice Credit Card®, 24-Hour Grace®, Standby Cash® and $50 Safety Zone® are federally registered service marks of Huntington Bancshares Incorporated. All Day Deposit℠ is a service mark of Huntington Bancshares Incorporated. The 24-Hour Grace® system and method is patented. U.S. Pat No. 8,364,581, 8,781,955, 10,475,118, and others pending.