By Dan Storer, Managing Director of Healthcare Corporate Banking, and Lucia Sprungle, Director, at Huntington Commercial Bank

Key takeaways

- Conservative good faith estimates for out-of-network care, especially among contracted groups and ancillary service providers, have unexpectedly led to rising patient overpayments.

- The cost of carrying credit balances while navigating the reimbursement and dispute process compounds an already strained financial situation for providers.

- Alleviating the challenge of reimbursing patients, especially unbanked and underbanked populations, has become a priority.

- Adopting digital payments to allow patients to choose their preferred payment method, including gift cards, mobile payment apps, and online money transfers, could improve acceptance and reduce balances.

The No Surprises Act (NSA) was introduced to shield patients from unexpected out-of-network charges and promote financial transparency within the healthcare system. Despite efforts to ensure billing processes comply with these provisions, many providers are now grappling with the complexities of patient overpayment costs. Rising credit balances and inefficient reimbursement processes are impacting healthcare organizations’ financial stability and operational efficiency.

Navigating these new challenges means shifting healthcare revenue cycle practices and payment systems to accommodate digital payment preferences and population needs. This article explores the unexpected provider costs of the No Surprises Act, the changing needs of patients, and opportunities to address the reimbursement issues providers face today.

Unintended consequences of good faith estimates

Underpayments cost hospitals and health systems an estimated 1-3% of their net revenue each year†. Providing patients with good faith estimates per the NSA’s requirements carries the risk of underbilling and further underpayments, so some providers have responded by taking a conservative approach to cost of care estimates. This is particularly prevalent among contracted groups in radiology and anesthesiology, and ancillary service providers such as air medical transport companies where billing complexities and variable costs can make precise estimates challenging.

However, this approach can lead to overpayment in situations where patients are required to pay in advance, such as those with a HDHP. Overpayments require providers to reimburse patients, which can be a time-consuming, cumbersome process.

The NSA’s new process for handling balance billing disputes between providers and payers adds further complication. The Independent Dispute Resolution (IDR) process, which begins after 30 days of unresolved billing disputes, requires third-party arbiters and substantial time and resources from healthcare organizations.

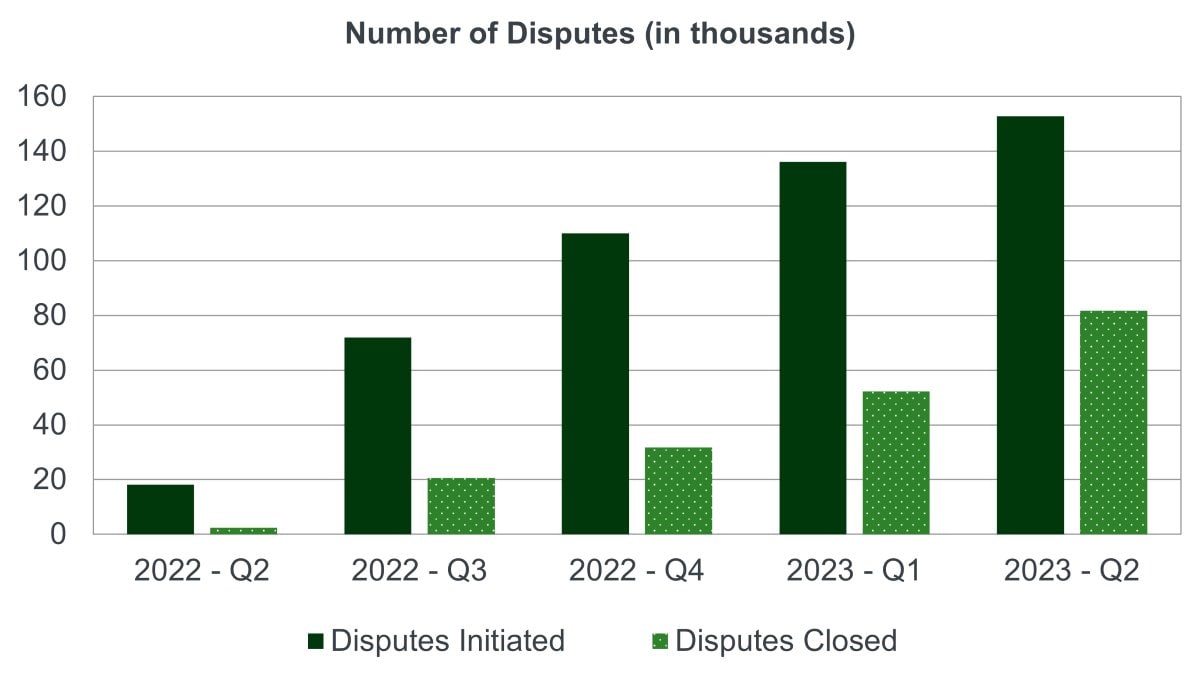

Since being signed into law, the No Surprise Act’s IDR process has driven an exponential number of disputes year-over-year. The number of disputes initiated between January 1, 2023 and June 30, 2023 was 13 times higher than what the Centers for Medicare & Medicaid Services (CMS) Agency projected for the entire calendar year‡. The chart below details the number of IDR disputes initiated compared to the number closed between April 2022 and June 2023.

Number of out-of-network disputes in the Federal Independent Dispute Resolution Process by calendar quarter, April 15, 2022 - June 30, 2023

View accessible image or CSV file

The number of disputes initiated in the second quarter of 2022 was 18,163 while the number of disputes closed was 2,445. In the third quarter of 2022, disputes initiated increased to 71,915 while disputes closed increased to 20,662. The fourth quarter of 2022 saw 110,029 disputes initiated and 31,714 disputes closed. In the first quarter of 2023 disputes initiated were 136,111 while disputes closed was 52,297. In the second quarter of 2023 disputes initiated were 152,699 with 81,739 disputes closed.

Each of those unresolved disputes, as well as every instance of overpayment, represents a credit balance carried by the provider, another costly consequence of balancing compliance with financial loss avoidance. Additionally, health systems now carry the burden of the administrative overhead of facilitating and adjudicating these disputes, which has necessitated the creation of dedicated teams or an increased cost of outsourcing services.

The cost of credit balances

Rising credit balances are more than a bookkeeping headache – this trend poses risks to an already strained landscape. The Health Research Institute projected a 7% increase year-over-year of medical costs to treat patients in 2024, up from 6% in 2023≠. Along with increased costs, healthcare organizations face ongoing, unresolved healthcare revenue leakage and clinical staff shortages.

While some providers might see these small overpayment balances as less significant in the face of other revenue pressures, these credit balances can really add up:

- Increased costs: Accrued interest on reimbursed balances can inflate operational expenses, and providers must allocate staff time that could otherwise be used for patient care or operational improvements.

- Disruption of revenue cycle management: Persistent credit balances complicate revenue cycle management and hinder accurate financial planning, leading to potential cash flow issues and reduced financial predictability.

- Noncompliance risk: If a CMS audit reveals unreimbursed balances outside the required reimbursement timeframe, organizations could be penalized.

Complications in reimbursing patients for overpayments

The NSA provide specific time periods in which providers are required to issue refunds after determining overpayment has occurred. Due to changing payment preferences and payer mix, accomplishing this is no easy feat.

Certain payment methods, such as credit cards, allow for easier reimbursement. The same cannot be said for checks, cash, or other methods. Attempting to issue refunds via checks, as is common practice, presents a multitude of difficulties. The top four we’ve seen as the most common are:

- Fraud: Check fraud is the most prevalent form of payment fraud. In 2023, 65% of surveyed organizations reported attempted or actual check fraudⱢ. Sending checks through the U.S. Postal Service (USPS) is increasingly risky, with more than 20% of organizations reporting fraud due to fraudsters interfering with USPS, up 10% from 2022Ⱡ.

- Lack of Information: Issuing checks requires healthcare providers to have accurate name and address information for the patient, which is not always captured at the time of payment.

- Uncashed Checks: Issuing checks to reimburse patients doesn’t always result in removing the credit balance. Checks are not deposited at a high rate, especially for lower dollar payments typical for reimbursements. 47% of checks under $40 are never cashedΩ, which leaves providers still carrying that unclaimed property balance and spending more to resend checks.

- Patient Frustration: Patient preferences should not be ignored. Every year, digital payments grow in use and popularity – and physical payment options decline. If given the choice, 75% of surveyed consumers want to pay medical bills online††. When receiving medical refunds, 21% of surveyed consumers have been frustrated by receiving a paper check for medical refund, and 24% expressed frustration at having no choice in how the refund was received‡‡.

Populations with no or limited access to bank accounts further compound the issue. Latest figures suggest 6% of U.S. adults§§ and 4.5% of U.S. households are unbanked, representing approximately 5.9 million households≠≠. An estimated 14.1% of U.S. households (18.7 million) are considered underbankedⱢⱢ. Without a bank account, many unbanked adults turn to non-bank check cashing or money orders to conduct financial transactions. Prepaid card use is also higher with this population, with 32.8% of unbanked households relying on themⱠⱠ.

Given these complications, issuing checks to all patients regardless of how they paid will result in ongoing credit balances and patient frustration. Providing faster, more reliable reimbursement processes and methods that address both patient and provider needs has become crucial.

Pivoting to digital patient reimbursement to mitigate revenue cycle risks

Rather than waiting for this to become a larger issue, healthcare providers can be proactive in adjusting billing systems and revenue cycle practices to ensure prompt refunds of overpayments. Accomplishing this could require changes throughout the entire revenue cycle, beginning with prioritizing the capture of accurate patient contact information at intake and setting expectations about estimates and reimbursements. The biggest shift will be in how providers handle transactions. Exploring alternative payment and reimbursement methods for refunds can help alleviate situations where the patient paid in cash, check, or other difficult-to-reimburse options.

Potential solutions include flexible payment options that allow patients to choose how they would like to be reimbursed.

- Direct ACH and credit card payments are common, but newer payment methods should also be considered.

- Digital wallets (e.g. PayPal, Venmo, Cash App, etc.) accounted for $13.9 trillion in global transaction volume in 2023, representing 30% of consumer spend at the point-of-saleΩΩ.

- Another survey found 31% of respondents expect to rely on a single digital wallet (such as Samsung Pay††† or Google Wallet‡‡‡) for payments this year§§§.

- Other payment methods to consider include PayPal or gift cards. These automated options provide access to reimbursement funds without need of a bank or check-cashing service.

Providers could opt to adopt a payment solution like ChoicePay® that allows patients to choose from all the methods above. They can elect for the reimbursement type that works best for them – potentially driving higher patient satisfaction scores. Doing so should increase reimbursement payment acceptance, reducing the burden of unclaimed property on the balance sheet.

Avoiding surprises in the No Surprises Act

Proactive strategies for revenue cycle management and reimbursement distribution have become imperative for healthcare providers to avoid financial loss due to underpayment or penalties for holding credit balances.

By understanding and addressing the patient payment difficulties posed by the No Surprises Act, providers can help ensure compliance and maintain financial health. Investing in solutions that allow patients to elect their preferred payment method from a wide array of options beyond traditional credit, debit, and check can help streamline operations and improve outcomes.