By Andy Arduini, Senior Managing Director, Global Advisory and Working Capital Finance, Huntington Commercial Bank and Ian Wyatt, Director of Economics and Commercial Market Strategist, Huntington Commercial Bank

Key takeaways

- Alternative sources of capital could help companies finance their global operations in the short term.

- Nearshoring and other strategies to lower risk in the supply chain could allow companies to preserve cost advantages.

- Diversifying, hedging, and securing payments could all help mitigate risk in unpredictable markets.

The global economy is presenting a challenging environment for international operations through inflationary pressures, supply chain risk, and geopolitical uncertainty. Though the global supply chain appears to be normalizing, we cannot predict when the next event will cause a new series of disruptions. Over the last decade, natural disasters, global conflict, and strikes have all caused disruptions and highlighted the global and interconnected nature of our supply chains.

Preserving cost advantages and mitigating risk abroad is a priority amidst these uncertainties. Identifying opportunities to build resiliency into the supply chain can help organizations better guard themselves against future unknowns.

The state of the global supply chain

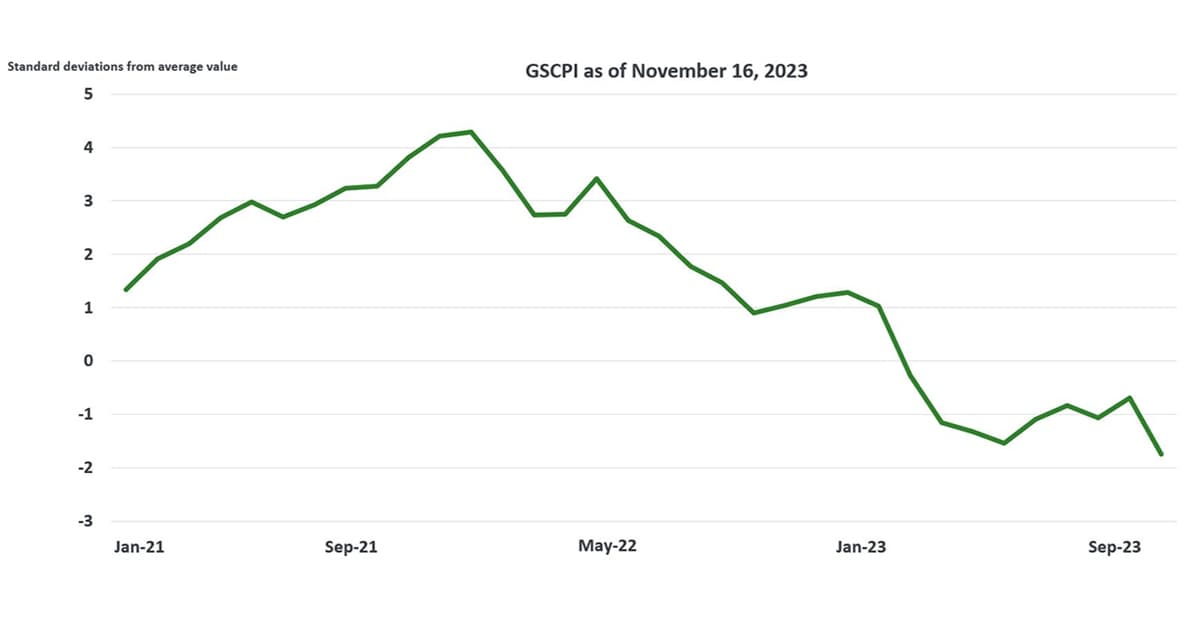

Global supply chains are faring better today than in 2022 and continue to show signs of recovery from the escalated demand and bottlenecks of the past few years. The Global Supply Chain Pressure Index (GSCPI), which uses transportation cost data and manufacturing indicators to measure supply chain conditions, has reported a steady decline in pressures since December 2021, where the figure reached a record high†. Current estimates for the end of 2023 are around -1.74, the lowest recorded number since 1997‡.

Download a copy of the Global Supply Chain Pressure Index (GSCPI) here.

Though global supply chains appear to be normalizing based on these estimates, changing market conditions and ongoing inflation continue to impact organizations’ bottom lines. Recent S&P Global Market Intelligence data predicts that global manufacturers’ gross operating profit margins will fall to 10.4% of sales in 2024, down from 10.7% in 2022§.

These factors, combined with easing pressures, could signal lower demand and a slower economy.

Alternative global operations financing in a complex environment

The very favorable funding market conditions over the past decade (e.g., abundant market liquidity and historically low interest rates) allowed companies to focus less on working capital initiatives in favor of more longer-term initiatives. A dramatic shift in priority is occurring as companies adapt to the new reality, which seems set to endure. Leaders are now facing a complex financing landscape, conservative market conditions, and elevated rates across multiple markets. Many are responding to this by focusing less attention on long-term strategic investments and more on short-term solutions to fund and optimize day-to-day operations.

These alternate sources of capital may help companies maintain operations to secure themselves in a fundamentally different and less certain future.

Alternate funding opportunities can include diversification strategies such as:

- Selling accounts receivable to financial institutions to often secure more attractive interest rates and flexible terms than available with traditional debt financing.

- Pursuing supply chain financing strategies to optimize working capital and add vitality to supply chains.

- Working with a financial institution to enhance collateral, such as through U.S. government guarantee programs.

There are many options here, so it is advisable for companies to consult with their financial advisors to determine the best fit for their needs.

Preserving global supply chain cost advantages

Organizations are seeing a myriad of factors eating away at the cost advantages gained by manufacturing or sourcing abroad. As financial indicators point to a slower economy, those cost benefits could be even further threatened. Improving the efficacy of supply chains in the wake of these predictions has become a priority for many.

The practice of nearshoring to maintain those advantages while reducing risk remains a hot topic among leaders. Companies operating abroad to sell in the U.S. have increasingly turned toward Mexico to reposition operations or supplier relations. In May 2023, total Mexican exports reached $52.9 billion, a 5.8% increase from the previous year≠, and Mexico has eclipsed China to become the U.S.’ largest trading partnerⱢ. In 2023, manufactured goods represented 88.6% of all Mexican exportsⱠ.

Organizations should keep in mind nearshoring is not always the right strategy. Moving supply chains and productions closer to the market into which a company is selling can be complex and expensive.

Those unable to nearshore could instead look for ways to remove links in their supply chain, such as diversifying supplier lists or material sources. Supply chain financing, as mentioned earlier, could also help stabilize a supply chain and allow companies to maintain their cost advantages abroad.

Mitigating risk amidst global market unpredictability

The current global climate has added a layer of unpredictability, which weighs heavily on companies operating abroad. Geopolitical conflicts further compound on this issue, making it unsustainable for organizations to maintain a business-as-usual approach. Risks abroad could lead to losses, and companies cannot predict future conflicts or disasters. A resilient global supply chain could be the difference between surviving a major incident and being unable to continue operations.

Organizations are building a more resilient supply chain, and the primary way they are doing so is by understanding all facets of those areas of risk and adopting risk mitigation strategies, which include:

- Utilizing financial instruments to hedge against currency fluctuations and commodity price changes, which can protect against sudden cost increases.

- Diversifying the supply chain by sourcing from multiple countries or regions to mitigate the impact of localized economic instability or geopolitical strife.

- Securing credit insurance or letters of credit through a financial institution that can protect against payment risks.

Navigating global supply chains next year and beyond

Adapting to the evolving dynamics of the global supply chain is no easy feat. Organizations able to find innovative solutions to maintain and grow within the current environment could be better positioned for the future. Contact our team to learn more about managing your international trade risk and protecting against uncertainties.