The accelerated pace of technological change is having a profound impact on the procurement of healthcare equipment. Medical devices are increasingly taking on the characteristics of IT assets — including network requirements, data and storage architectures, and information security concerns. As a result, hospitals face new obstacles in planning and financing the acquisition of these devices, including shorter refresh cycles and greater uncertainty about asset replacement.

Here are three factors that healthcare organizations may want to consider when estimating the longevity of medical devices and evaluating the economic advantages of leasing.

1. Predicting the Replacement Cycle

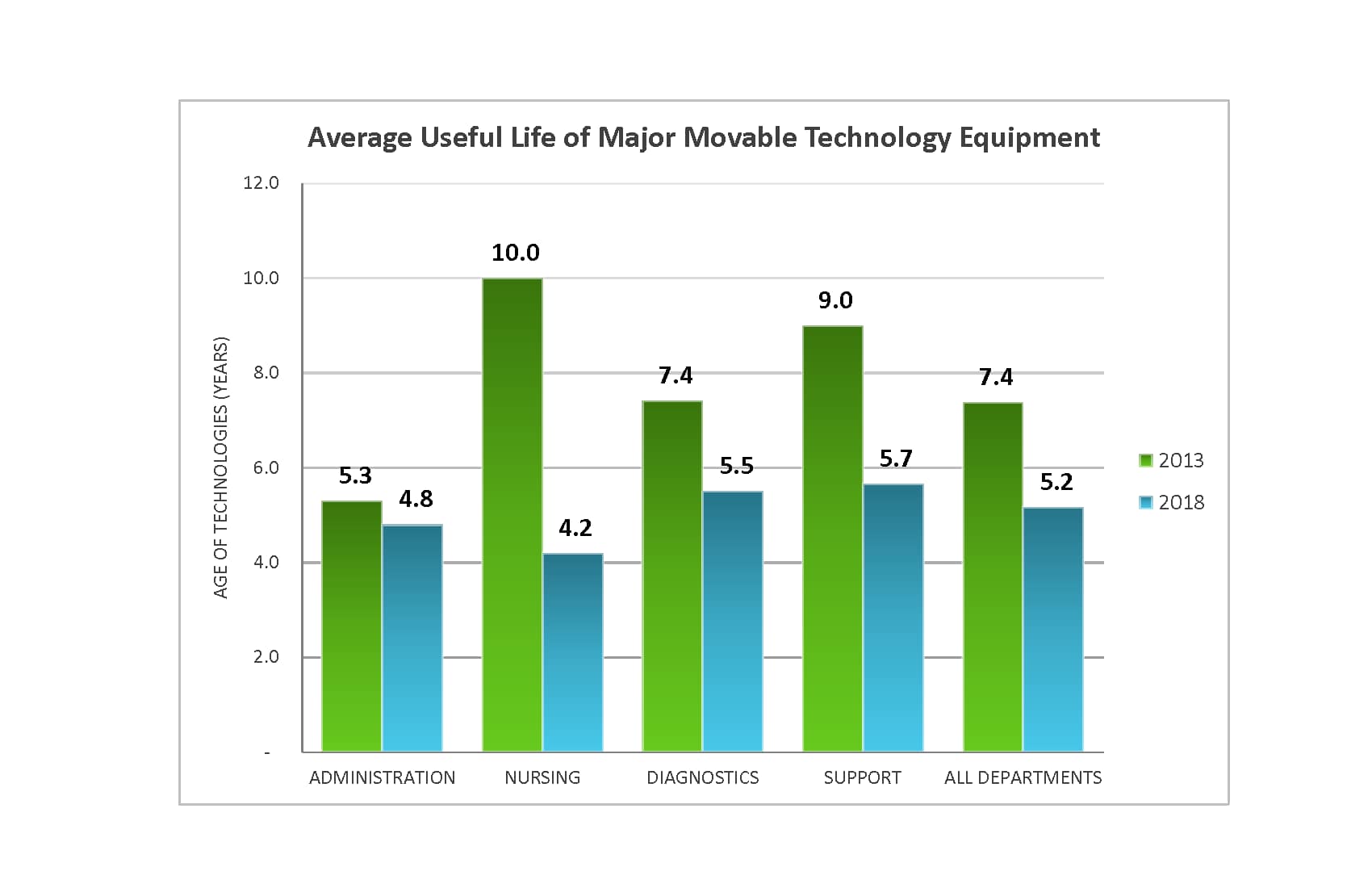

One method used by hospitals to determine if medical devices should be replaced is to analyze historical data and identify trends that can be extrapolated into the future. In comparing the lifespans of new devices in the 2013 and 2018 editions of the American Hospital Association (AHA) publication, “Estimated Useful Lives of Depreciable Hospital Assets,” it shows that the average useful life for major movable technology equipment dropped by 2.2 years.1.

While historical trends can be a useful guide, they cannot warn us of significant developments in medical devices on the horizon that may offer greater economic value or better patient outcomes. For example, many advanced monitoring devices currently in use may be superseded by less complex devices that connect to and are controlled by smartphones or tablets.

To anticipate these developments, hospitals can monitor indicators of market changes1, including:

- Vendor announcements of new products and services

- Published results of pilot programs

- Early statements released by regulatory bodies

- Analysts’ forecasts

For first-generation devices that are too new to be listed in the AHA publication, leasing provides a way for hospitals to adopt and capitalize on the benefits of these new technologies and also quickly replace them with second-generation versions which may be cheaper and more full-featured.

2. The Impact of Innovation

The rate of innovation often creates a need for replacement aside from traditional useful life considerations. For example, demand increases for state-of-the-art equipment when critical activities are involved, such as scanning for fetal abnormalities. As a result, ultrasound technology is advancing quickly as manufacturers add new functionality and improve image quality and portability. Because these devices may be considered obsolete well before they have reached the end of their useful lives, leasing can be an attractive option.

For assets whose replacement or refresh cycles are difficult to determine due to uncertainty about the future direction of the technology, leasing may offer the flexibility to change or return devices early in the event that technological innovations render them obsolete.

3. Avoiding Hidden Costs

Cost is another factor that favors shorter refresh cycles. As noted above, healthcare technology is becoming more like IT as microprocessors and computers are increasingly being incorporated into medical equipment. And just like older IT assets, aging medical devices can require a higher level of technical support which may place increasing demands on staff time and reduce productivity. Often, the productivity gains alone provide sufficient justification for a shorter refresh cycle2.

How We Can Help

Procurement of healthcare technology requires careful planning and financing to help keep up with the rapid pace of advancements. Leasing medical devices can be a highly effective strategy for realizing cost savings, process efficiencies, and deployment benefits without increasing risk or management overhead. Contact us to learn more.