Media Contact:

Emily Smith

emily.smith@huntington.com

(614) 480-6834

COLUMBUS, Ohio - October 8, 2020

Huntington (Nasdaq: HBAN; www.huntington.com) is the nation’s largest originator, by volume, of Small Business Administration (SBA) 7(a) loans for the third consecutive year at the close of SBA fiscal year 2020, further strengthening its position as the leader in supporting small businesses. This also marks the 12th year in a row Huntington has been the largest originator, by volume, of SBA 7(a) loans within its footprint.

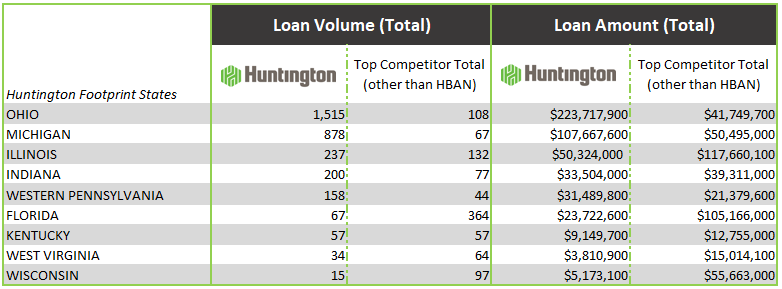

The number of businesses Huntington helped through SBA lending in each footprint state through the 2020 fiscal year includes:

This announcement follows Huntington’s recent efforts in supporting its customers by processing more than 38,000 Paycheck Protection Program loans across its footprint in 2020. These loans provided support to businesses during an extremely difficult time and further demonstrated the bank’s commitment to looking out for people.

“We believe small businesses are the lifeblood of our communities,” explained Steve Rhodes, Huntington’s Business Banking Director. “For more than a decade, we’ve been building and deepening our expertise helping small businesses navigate through every stage of owning a business, and this year, our customers depended on us more than ever before. We’re pleased to have earned the top spot again, but more importantly, to have assisted small businesses when they needed it most.”

“The pandemic helped shine a light on the importance of the Small Business Administration, and SBA loans will continue to be a great source of capital for a wide range of businesses going forward,” said Huntington’s SBA Program Director, Maggie Ference. “This is a year many will never forget, and we are so proud to have leveraged our expertise in supporting our small business customers by providing the right solution for customers at every stage.”

Last month, Huntington announced 24-Hour Grace® for Business and a no overdraft fee $50 Safety Zone℠ further helping customers manage their long-term financial health. These new features help customers avoid paying overdraft fees.

Huntington continues to invest in its communities to support economic inclusion and to help make our customers and our communities more financially secure in the future. On September 1, the bank announced its new, five-year, $20 billion Community Plan focused on economic opportunity for people, small businesses, and communities throughout its seven-state footprint. This includes a $7.6 billion lending commitment to helping businesses through business-planning and educational programs to bring business owners the relief, recovery and growth they are seeking as the cornerstones of the American economy.

The SBA 7(a) lending program provides government backing, enabling small business lenders to extend credit to business owners who are not yet able to access conventional bank financing. For more information, visit www.huntington.com/SmallBusiness/loans/sba-guarantee-business-loans.

About Huntington

Huntington Bancshares Incorporated is a $175 billion asset regional bank holding company headquartered in Columbus, Ohio. Founded in 1866, The Huntington National Bank and its affiliates provide consumers, small and middle‐market businesses, corporations, municipalities, and other organizations with a comprehensive suite of banking, payments, wealth management, and risk management products and services. Huntington operates more than 1,200 branches in 12 states, with certain businesses operating in extended geographies.