Standby Cash®

Easy to use, easy to repay, easy to establish credit.

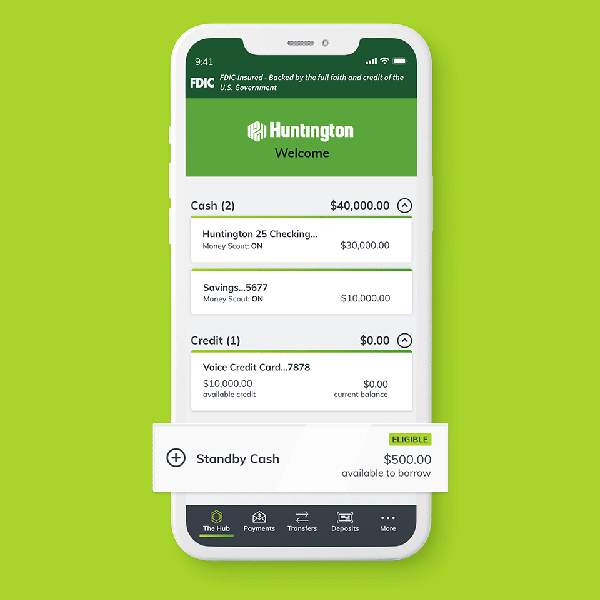

Standby Cash is a convenient digital line of credit available to eligible Huntington checking customers. Open it instantly online or in the Huntington Mobile app—no calls, no paperwork, no trip to the bank. You can practically expect the unexpected these days, so having a little safety net is a big help. Instantly transfer cash when you need it to your checking account.

Once you qualify, instantly access between $100 and $500 with our do-it-yourself, digital only line of credit. Eligibility is based primarily on your checking and deposit history, not your credit score.

Just pay a 5% cash advance fee when you make a transfer. Pay it back over three months and there's no monthly interest charge when you set up automatic payments. Otherwise, a 1% monthly interest charge (12% APR) applies to the outstanding balances†.

Switch to Huntington

We could all use a little cash on standby.

It might seem too good to be true, we get that. But it's our way of looking out for people.

Three quick facts about Standby Cash

Does it affect your credit?

Standby Cash is not based on your credit, but once you open it, the account and your activity are reported to credit bureaus, which could positively or negatively affect your credit score.§

Can it help avoid overdraft fees?

If you believe you're going to overdraw your account, you can use Standby Cash and make a transfer to prevent the overdraft from occurring. If you do not bring your account positive while 24-Hour Grace¶ is in effect (before midnight central time the next business day), your Standby Cash line will be suspended from further use until your account is no longer negative.†

Can I use it anytime?

Once you open Standby Cash, it’s available instantly, and for as long as you remain eligible. Standby Cash works as well in a plan as it does in a pinch.

How do I qualify for Standby Cash?

To qualify for Standby Cash, you need $1,000 or more in monthly deposits to a Huntington personal checking account for three consecutive months, and an average daily balance of $200 or more in your checking account. Other eligibility requirements apply, including your recent overdraft and/or return history†. Standby Cash is available to Huntington customers with a personal checking account. Find the account that is best for you and get started on your way to qualifying for Standby Cash.

Ready to get your Standby Cash?

If you're already a Huntington checking customer, you're halfway there.

Log in to online banking or the Huntington Mobile app to see if you qualify.

Open Standby Cash with just a few clicks.

Standby Cash is available for immediate transfer into your checking account.

Answer: Standby Cash is a digital-only line of credit available to Huntington customers based primarily on your checking and deposit history, not your credit score. We do not check your credit score prior to you enrolling in Standby Cash, however once you enroll, we will report account activity such as open date, line usage and payment history immediately after enrolling. It’s money you can borrow on an ongoing basis, so long as you remain eligible. Lines of credit allow you to use money, repay it, and then use it again without needing to reapply. Eligibility for Standby Cash is based on your account balances, monthly deposits, and overdrafts. In order to see if you are eligible for Standby Cash, customers will need to enroll in online banking at Huntington.com. For eligible customers who have enrolled in Standby Cash - money can be transferred immediately into your Huntington deposit account.

Just pay a 5% cash advance fee when you make a transfer. Pay it back over three months and there's no monthly interest charge when you set up automatic payments. Otherwise, a 1% monthly interest charge (12% APR) applies to the outstanding balances†.

Answer: Upon qualifying for Standby Cash, you have the option to open a Standby Cash account. Once opened, you can transfer any amount up to your Standby Cash credit limit into your account. Just pay a 5% cash advance fee when you make a transfer. Pay it back over three months and there's no monthly interest charge when you set up automatic payments. Otherwise, a 1% monthly interest charge (12% APR) applies to the outstanding balances†. To pay back Standby Cash free of interest, simply set up automatic payments, and pay back the amount you transferred over three months. Without automatic payments, there is 1% monthly interest on your current balance (12% APR). Once the money is paid back, it's available to use again so long as you maintain eligibility.

Answer: Managing money isn’t always easy, there are times when money gets tight - we created Standby Cash to help. We understand unpredictability and what our customers go through. We’re for people, and our mission is to reinvent banking so that it looks out for people, just like you.

Answer: To qualify for Standby Cash, you must:

- Enroll in online banking.

- Maintain an open checking account with a minimum of $1,000 deposited each month for three consecutive months.

- Keep an average daily balance of $200 or more in your checking account for the past 30 days.

- Have none of your Huntington accounts overdrawn for more than 24 hours.

- Not have an active or recent bankruptcy or other legal process.

- Be over 18 years old.

- Have an address within our service area (Ohio, Colorado, Illinois, Indiana, Kentucky, Michigan, Minnesota, Pennsylvania, South Dakota, Wisconsin, and West Virginia).

- Be a U.S. citizen or non-U.S. citizen with a social security number or taxpayer identification number.

- Meet other eligibility requirements, including your recent overdraft and/or return history.

Answer: Login to online banking at huntington.com or the Huntington Mobile App to check eligibility. Look for Standby Cash under your Credit section on The Hub. If you are eligible, we will show your available line amount there.

Answer: Standby Cash is available to customers once they reach all eligibility requirements, including having $1,000 or more in monthly deposits for three consecutive months, and an average daily balance of $200 or more in your checking account for the past 30 days. Your recent overdraft and/or return history can impact your eligibility. Other eligibility requirements apply.†

Answer: Standby Cash credit limits are determined based on your deposit activity and account balances at each statement cycle. You will receive an alert via email and/or text notifying you of any changes to your credit limit. Message and data rates may apply.

Answer: Yes! As long as you continue to meet eligibility requirements, you can use Standby Cash as many times as you need. If you use 90% or more of your Standby Cash credit limit at any point over three consecutive statement cycles, your Standby Cash account will be suspended until the entire balance is paid off.

Answer:

To maintain eligibility for Standby Cash, you must:

- Maintain an open checking account with a minimum of $1,000 deposited each month.

- Have maintained average daily balance of $200 or more in your checking account over the previous 30 days.

- Have none of your Huntington accounts overdrawn for more than 24 hours.

- Not have an active or recent bankruptcy or legal process.

- Keep your usage below 90% of your Standby Cash credit limit.

- Have no more than two overdrafts and/or return transactions on your qualifying Huntington checking account in the past 96 days, regardless of whether you are assessed a fee.

For complete details, please see your Standby Cash Terms and Conditions upon enrollment.

Answer: Your Standby Cash account remains open as long as you remain eligible and your qualifying deposit account remains open. If you want to close the Standby Cash account, contact us at 800-480-2265.

Answer: No. If you close your qualified checking account, you will no longer have access to make additional transfers from your Standby Cash account. Your Standby Cash account will be visible until your outstanding balances are paid off. Once paid off in full, your Standby Cash account will be closed.

Answer: You can make your payments through transfers within online banking, or you can set up automatic payments. Pay it back over three months using automatic payments, and there's no monthly interest charge. Otherwise, a 1% monthly interest charge (12% APR) applies to the outstanding balances.

Answer: Yes, customers can make payments at any time within The Hub in online banking.

Answer: You'll get an alert via email and/or text before your payment is due, and another alert if a payment is past due. Message and data rates may apply. If your account has a past due amount, you won't be able to transfer any more money from Standby Cash. You can still make payments though. Failure to pay can result in account default and closure. We report account activity to credit bureaus, so your use could positively or negatively affect your credit score. To make it more convenient, set up automatic payments so you don’t have to worry about remembering payment dates.

Answer: Automatic payments won't overdraw your account. However, automatic payments reduce the amount of money in your account to cover other transactions, so you should ensure your account has sufficient funds. If your account balance doesn't cover an automatic payment on the day it is due, we'll automatically attempt the payment again when you have sufficient funds.

Answer: We understand that overdrafts happen. If you are enrolled in Standby Cash, you can access your Standby Cash credit line for help. If you believe you're going to overdraw your account, you can use Standby Cash and make a transfer to prevent the overdraft from occurring. If you do not bring your account positive while 24-Hour Grace¶ is in effect (before midnight central time the next business day), your Standby Cash line will be suspended until your account is no longer negative.†

Answer: Just pay a 5% cash advance fee when you make a transfer. Pay it back over three months and there's no monthly interest charge when you set up automatic payments. Otherwise, a 1% monthly interest charge (12% APR) applies to the outstanding balances†.

Answer: Opening a new account may cause your credit score to fluctuate. Although we don't look at your credit score to determine eligibility, the Standby Cash line of credit will be reported to credit bureaus as a new account. New debt may cause your credit score to drop. But as you continue making on-time payments on your new account, your responsible debt management will also be reflected in your credit report. As a result, you might see your score rebound.

Answer: We report the Standby Cash line of credit and its current balance to the credit bureau within 1–2 weeks after opening an account. Utilization rate is the percent of available credit you're using, and it's an important factor in determining your credit score. Higher utilization rates can hurt your score, lower utilization rates can help.

Answer: Missed payments can have a negative impact on your credit score. Lenders want to be sure you can pay back debt on time when they are considering you for new credit. On-time payments demonstrate you can manage new debt responsibly and credit scores may improve with positive payment history.

Answer:

| Weight | Key Factor (FICO®#) | Behavior Tips |

| 35% | Payment History | Make payments on time. Enroll in automatic payments. |

| 30% | Credit Usage | Keep your credit utilization ratio low (less than 30% of your available credit is recommended). |

| 15% | Credit History Length | The longer your credit history, the higher your credit score may be. |

| 10% | Credit Mix | Carry a diverse portfolio of credit accounts, which might include a mix of car loans, credit cards, student loans, mortgages, or other credit products. |

| 10% | New Credit | Too many accounts or inquiries can indicate increased risk and could lower your score. |

Answer: Standby Cash credit limits are based on your deposit activity and account balances. While you can’t request a change, you might become eligible for a higher amount based on your account activity. If you need access to more money, talk to your Huntington banker about other options like a personal loan.

Answer: You can transfer any amount of Standby Cash, from $1 to your full Standby Cash credit limit. You can make multiple transfers and pay back each transfer in equal installments over three months. If you use 90% or more of your Standby Cash at any point three months in a row, your account may be suspended until you pay back the full amount you've used. Don’t forget that a high credit utilization rate (the amount of total available credit that you are using) has the potential to negatively impact your credit score.

Answer: A line of credit is money you can borrow on an ongoing basis. With a line of credit, you can have access to funds as needed, within a predetermined credit limit. Lines of credit allow you to use money, repay it, and then use it again without needing to reapply.

Answer: APR stands for Annual Percentage Rate. It is the amount of interest you will pay annually on money that you borrow. If you do not set up automatic payments to repay your Standby Cash, you will pay a 1% monthly interest charge (12% APR) on outstanding balances.

Contact Us

Automated Assistant

Quick answers when you need them

Speak with Us

We are here to help

Find a Branch

Find your nearest Huntington Branch

§ Although we will not use your credit score to determine eligibility, once you open Standby Cash we will begin to report the account and your activity to the credit bureaus. Standby Cash may positively or negatively affect your credit score.

¶ Your account will be automatically closed if it remains negative in any amount for 60 days, including if your account is overdrawn within our $50 Safety Zone. Learn more at huntington.com/SafetyZone and huntington.com/Grace.

FICO® is a registered trademark of the Fair Isaac Corporation in the United States and other countries.

Standby Cash®, 24-Hour Grace®, and $50 Safety Zone® are federally registered service marks of Huntington Bancshares Incorporated. The 24-Hour Grace® system and method is patented. U.S. Pat No. 8,364,581, 8,781,955, 10,475,118, and others pending.