Take your team with you wherever you go.

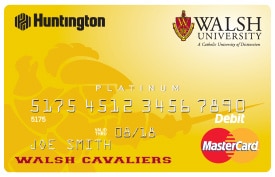

Get a customized Huntington Debit MasterCard® and bank like a true fan.

Already have an account? Call us today to get your team's card. (1-800-480-BANK 2265)

Buckeye BankingTM

The Ohio State University

Blue Jackets BankingSM

Columbus Blue Jackets

Columbus Humane

Capital Area Humane Society

Switch to Huntington

Steel Town Banking®

Pittsburgh

Colts Banking

Indianapolis Colts

Rockets Banking

The University of Toledo

Vikings Banking

Cleveland State University

Cavalier Banking

Walsh University

Clippers Banking

Columbus Clippers

Open a Checking Account Online

Huntington Platinum Perks Checking®

Huntington Perks Checking®

Asterisk-Free Checking®

No cost to open and no monthly maintenance fees.

Checking Account Features

Huntington Checking accounts are loaded with features designed to look out for you and your financial well-being.

We are here to help

If you can’t find what you’re looking for, let us know. We’re ready to help in person, online, or on the phone.

Call Us

To speak to a customer service representative, call (800) 480-2265.

‡Total Relationship Balance. Refer to Personal Account Charges Form for detailed explanation of Total Relationship Balances. You can avoid the monthly checking maintenance fee for any statement period for Huntington Perks Checking® if you have $1,000 in monthly deposits or if you keep a Total Relationship Balance of at least $5,000 in eligible deposits. You can avoid the monthly checking maintenance fee for any statement period for Huntington Platinum Perks Checking® if you keep a Total Relationship Balance of at least $25,000 in eligible deposits. Eligible deposits are deposits held directly with us or investments made through our affiliate, Huntington Financial Advisors® (HFA). They include this account and any other consumer checking, money market, savings, certificate of deposit (CD), and individual retirement accounts (IRA) on which you are an owner. Eligible investments are those in your name, made through us or which HFA reports to our deposit system for inclusion in the Total Relationship Balance, and generally include investments (both IRA and non-IRA) held in brokerage accounts and certain direct investments in mutual funds and annuities, as well as advisory account balances. Investments held in IRAs and agency accounts with Huntington Private Bank®, as well as personal agency accounts within the Trust Group that utilize your social security number, are also eligible. We figure the Total Relationship Balance each month by adding the qualifying balances, as we determine them, for all of your eligible accounts to the average daily balance of this checking account for the monthly statement period.

For Huntington SmartInvest Checking® you must maintain a Total Relationship Balance of at least $100,000. Your Total Relationship Balance includes eligible deposits held directly with The Huntington National Bank® (Huntington) or eligible investments made through our affiliate, Huntington Financial Advisors® (HFA). Eligible deposits include this account and any other consumer checking, money market, savings, certificate of deposit (CD), and individual retirement accounts (IRA) on which you are an owner. Eligible investments are those in your name made through Huntington or which HFA reports to our deposit system for inclusion in the Total Relationship Balance, and generally include investments (both IRA and non-IRA) held in brokerage accounts, certain direct investments in mutual funds and annuities, as well as advisory account balances. Investments held in IRAs and agency accounts with Huntington Private Bank® are eligible as well as personal agency accounts within the Trust Group that utilize your social security number, are also eligible. We figure the Total Relationship Balance each day by adding the qualifying balances (as we determine them) for all of your eligible accounts.

¶Free Non-Huntington ATM Withdrawals. With Huntington Platinum Perks Checking we’ll waive all and with Huntington Perks Checking your first 5 non-Huntington ATM cash withdrawal fees per statement cycle at any ATM worldwide. We’ll also reimburse you for withdrawal fees on the same transactions charged by the owner of a non-Huntington ATM. You will be responsible for any additional fees charged by the owner of a non-Huntington ATM as well as any international transaction or other fees charged by the network.

ҰRelationship rate benefit. The interest rate on your Relationship Money Market or Relationship Savings Account may be better when you also own a Huntington Perks Checking or Huntington Platinum Perks Checking account. Ask a banker to see a rate sheet for details. Your interest rates and APY will be determined based on your zip code.

^Monitoring Services The Monitoring Services are optional and are not available with all accounts. Enrollment requires agreement to the Services Terms & Conditions, which include important legal terms that a customer should read carefully before deciding whether to enroll.

# A Managed Investment account is an account where a financial advisor provides and implements investment advice tailored to your unique goals and preferences in exchange for an ongoing fee. Qualifying managed investment accounts include an investment management account offered through the Huntington Private Bank® or an investment advisory account offered through the Bank's affiliated registered investment adviser, Huntington Financial Advisors®. Accounts titled as corporate, business, and/or trust are not eligible.

Investment, Insurance and Non-deposit Trust products are: NOT A DEPOSIT • NOT FDIC INSURED • NOT GUARANTEED BY THE BANK • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • MAY LOSE VALUE

Õ For as long as you qualify for, and maintain, a SmartInvest Checking account.

## $50 Safety Zone and 24-Hour Grace. Your account will be automatically closed if it remains negative in any amount for 60 days, including if your account is overdrawn within our $50 Safety Zone. Learn more at huntington.com/SafetyZone and huntington.com/Grace.↩

¶¶ Zelle®. For your protection, you should only send money to those you know and trust, such as family, friends and others such as your personal trainer, babysitter or neighbor. If you don’t know the person or aren’t sure you will get what you paid for, you should not use Zelle® for these types of transactions.

≠≠ Must have a bank account in the U.S. to use Zelle®.

†† Early Pay. You may receive a direct deposit up to two days early with Early Pay if 1) you have a checking account with us, 2) a recurring qualifying direct deposit, and 3) provide us a valid email address. It is at our discretion to identify which recurring direct deposits are eligible for Early Pay and it may take up to 90 days to identify those deposits that qualify. We cannot guarantee that you will receive the Early Pay service due to unanticipated circumstances. Early Pay is automatic and there is no fee. You can opt out of the Early Pay service at any time, by contacting a branch or calling our service center at (800) 480-2265 and asking to have Early Pay removed. For more information, please see a Consumer Deposit Account agreement, or contact a branch. Learn more at huntington.com/EarlyPay. Receive recurring qualifying direct deposits up to two days early at no charge. Some direct deposit types are not eligible.

‡‡ Funds Availability. The first $500 of your total daily check deposits made at a branch, ATM, through Mobile Deposit, or Huntington Deposit Scan (for businesses) may be available to you immediately on the day we receive your deposit. For check deposits made from Saturday through Monday and Federal Holidays, up to $500 in total may be available immediately from all your check deposits over those days. Your remaining check deposit amount(s) will generally be available on the next business day. Subject to eligibility; longer holds and exclusions may apply. Please see your Funds Availability Policy for more detail.

Asterisk-Free Checking®, 24-Hour Grace®, $50 Safety Zone®, SmartInvest Checking®, Standby Cash® Huntington Perks Checking®, and Huntington Platinum Perks Checking® are federally registered service marks of Huntington Bancshares Incorporated. All Day Deposit℠ is a service mark of Huntington Bancshares Incorporated. The 24-Hour Grace® system and method is patented. U.S. Pat No. 8,364,581, 8,781,955, 10,475,118, and others pending.

All trademarks of The Ohio State University used under license.

"Blue Jackets" and "Columbus Blue Jackets" are the property of COLHOC Ltd. Partnership and the National Hockey League and are used with permission. Huntington is the official financial services provider of the Columbus Blue Jackets.

All trademarks of The Columbus Clippers are used under license.

Buckeye Banking™ is a trademark of The Ohio State University and used under license.

Bank Like a Fan!® and Steel Town Banking® is a registered service mark of Huntington Bancshares Incorporated.

MasterCard, Debit MasterCard and the MasterCard Brand Mark are registered trademarks of MasterCard International Incorporated.